The Best Prop Trading Firms in 2026

Showing Results: 1 - 15 / 57

Rating breakdown

Things we liked:

Unlimited time for completionReal Funding and Daily Payouts

Things we didn't like:

High challenge difficultyRating breakdown

Things we liked:

Unlimited time for completionReal Funding and Daily Payouts

Things we didn't like:

Futures onlyNo free retry

Rating breakdown

Things we liked:

Up to 100% Profit SplitUnlimited Number of Trading Days

Fast Payouts

Things we didn't like:

10% Max Loss Limit on Accounts$10 Withdrawal Processing Fee

No swap free accounts

Rating breakdown

Things we liked:

No Trading RestrictionsMetaTrader4, MetaTrader5

Things we didn't like:

Minimum Trading DaysTrailing Drawdown

Rating breakdown

Things we liked:

No restrictions on trading styleOvernight and weekend holding allowed

Things we didn't like:

Minimum 5 trading daysRating breakdown

Things we liked:

FTMO charges a one-time fee onlyFTMO has generous conditions for its traders

Things we didn't like:

Complaints about the platform freezingComplaints about lack of customer support

Rating breakdown

Things we liked:

Lower Profit TargetGood Pricing

Things we didn't like:

It is hard to become a Funded TraderOnly Futures Trading

Fee is not refundable

Rating breakdown

Things we liked:

Up to 2M in fundingNo Time Limit

Industry-standard MT5 platform with real liquidity

Things we didn't like:

A Relatively New player in the funded account offeringRating breakdown

Things we liked:

Let you trade with leverage of up to 1:30Things we didn't like:

5%ers Challenge fee is on the higher end of the spectrumThere are other holes in the 5%er offer

Rating breakdown

Things we liked:

Instant payouts with no minimum trading days.Own trading platform with a modern interface

Competitive assessment costs

Things we didn't like:

No high-risk instruments or cryptocurrencies to trade.Non-refundable assessment fee.

Rating breakdown

Things we liked:

Instant fundingEAs allowed

Raw spreads

Bi‑weekly payouts

Things we didn't like:

Limited public dataRating breakdown

Things we liked:

No deadlines80 %–90 % split

Multi‑asset

Things we didn't like:

No free retryNo instant funding

Rating breakdown

Things we liked:

Unlimited time100 % first $20 K

Weekly payouts

Things we didn't like:

Futures onlyNo free retry

Rating breakdown

Things we liked:

No deadlinesWeekly payouts

Live fills

Things we didn't like:

Futures onlyNo free retry

Rating breakdown

Things we liked:

Multiple programsEAs & copy trading

Raw spreads

Add‑on to 90 %

Things we didn't like:

No scaling planNews‑time limits

| Prop Firm | How much they charge - Challenge Fees |

|---|---|

| FunderPro | FunderPro offers four tiers of funded account challenges: a $25K balance costs $250, a $50K balance costs $300, a $100K balance costs $550, and a $200K balance costs $995. Scaling plan up to $5 million. |

| FunderPro Futures | Challenge fees: $79–$299 (no hidden costs) |

| Funding Pips | Fees range from $100 to $500. $100 for a 5K account; $200 for a 10K account; $300 for a 25K account; $400 for a 50K account; $500 for a 100K account. |

| FXIFY | Assessment fees range between $175 and $1,999 depending on the capital access you need, with pricing increasing as funding does. |

| FundedNext | For FundedNext evaluation model, you pay for the challenge costs from $99 for a $15,000 funded account to $999 for a $200,000 funded account. |

| FTMO | The FTMO Challenge with an initial capital EUR 10k balance costs €155; 25k balance for €250; 50k balance for €345; 100k balance for €540; 200k balance for €1080; Scaling plan up to $2 million. |

| Apex Trader Funding | |

| Bullwaves Prime | |

| the5ers | The 5%ers Challenge an initial $6,000 balance costs €235; $10,000 balance for €385; $20,000 balance for €745 and a Scaling plan up to $4,000,000. |

| SabioTrade | SabioTrade offers four account tiers: $10K, $50K, $100K, and $200K. The prices are $50, $289, $479, and $939, respectively. |

| Top One Futures | |

| Take Profit Trader | Monthly Test fee: $150–$360 (PRO reset one‑off fee) |

| NeomAAA Funds | Instant $99–$1 839 • 1‑Step $55–$596 • 2‑Step $52–$485 |

| ThinkCapital | Lightning $59–$949 • Dual‑Step $59–$949 • Nexus $59–$949 |

| Hola Prime | Fees TBA (launch 2025) |

| UltraCap Trading | |

| MyFundedFX | |

| TX3 Funding (Toptier Trader Rebrand) | Prices for the challenges at Top Tier Trader begin at $250 for a $25k account and top out at $1399 for the $300k challenge. a $25K balance costs $255, a $50K balance costs $50, a $100K balance costs $560, $200K balance costs $999 and a $300K balance for $1399. |

| BlueBerry Funded | |

| Topstep | The TopStep Challenge with an initial balance $50K costs $165; $100K balance for $325; $150K balance for $375 (per month) |

Funded trading accounts Guide

Top funded trading accounts Guide Contents

- 1. Funded Trader Program

- 2. What is a funded trading account?

- 3. How does it work?

- 4. How do you get a Funded Trading account?

- 5. Can I become a Funded Trader?

- 6. Choosing the best Funded Trader program for you!

- 7. The Best Funded Trader Programs for 2026

- 8. Compare Funded Trading Accounts Programs

- 9. What do you need to know before becoming a Funded Trader?

- 10. Pros and cons of being a funded trader

- 11. Observations

- 12. Help Me Choose A funded trading account

- 13. Funded Trader FAQs

View more

Funded Trader Program

A Funded Trader program is the best of both worlds. Whether you are a beginner in the trading industry or you are an experienced trader, the program gives you the opportunity to explore the trading world without the risk of losing your capital. There are no doubt Funded Trader programs / challenges have heaps of benefits. Many providers’ offer great services and communities of like-minded traders that can share their knowledge and skills and have you climbing the trading ladder in no time. Below, we will explain all there is to know about a Funded Trader account. We will start by going through exactly what a Funded Trader account is, how it works, the diverse types of accounts offered, how to join the program, and how to choose the best option for you.

Do you want to get funded? Keep reading to enhance your trading journey!

What is a funded trading account?

In simplified terms, a funded trading account is a proprietary trading account that enables qualified traders to use capital provided by the Prop Trading Firm to trade while developing the firm's financial transactions. The organization offers a fully funded account to develop your trading acumen while sharing the overall profits earned.

Essentially, you will be using your skills and knowledge in trading to trade without needing the start-up capital. You will receive a set percentage of the profits on the Funded Trading account provided you meet the set criteria provided by the organization. Since you have no emotional attachments to the capital, you have the freedom to make your own rational decision to grow the funds and earn a percentage of the profit.

It benefits both the funded traders and trading brokers, but there are a few more details to cover before deciding if this is the route you want to take.

How does it work?

The Funded Trader account is designed to attract individual traders to trade using the organization’s capital. It is basically a three-step process to start off with.

Firstly, you would select the program you want to join. Most likely, you will start off on a demo account to familiarise yourself with the platform. This is essentially a realistic representation of the trading platform and market that will be used when you start trading with a live funded account. In this stage traders show off their skills and demonstrate their ability to make profits over an extended period of time. The key to passing this stage is to continually develop your skills by dedicating your time to training and speaking to more advanced traders in the community to learn some extra tips and tricks to add to your trading acumen. Familiarise yourself with different trading techniques and styles to add to your advantage.

Secondly, there is a verification stage where you will be granted another account to continually improve your skills and knowledge and earn profits while doing so. During this stage, you have the opportunity to practice your techniques and put your training into practice. See what works for you and what you would rather avoid doing. Continually build your trading portfolio and enhance your skills.

Once you have passed the first two stages, you will get access to a live account and get funded whilst receiving the benefits that go along with it. You have finally passed the initial evaluation stages; your arduous work has paid off and you now have a Funded account. You are officially a Funded Trader. This does not mean; you can now sit back and relax while the funds come rolling in. This is the most important stage since this is your opportunity to generate income for your hard-earned efforts. You have a responsibility to yourself and the third-party to reach the profit targets to earn your share of the profits. Each stage has its own set of requirements to advance to the next stage depending on the program you choose, so make sure you set a trading plan for yourself to meet the criteria’s.

How do you get a Funded Trading account?

Different providers, have different requirements and methods for signing up. As mentioned before, your first step would be to select the account size you are interested in. Bear in mind, the same amount will be given in both demo and live stages of the Funded Account. Once you have proceeded with the checkout, successfully sent the entry fee amount, and filled in the necessary details, you will receive login details to a specialised dashboard dedicated to Funded accounts. Once the login details have been received, you can log in to the platform to start trading! Easy enough, right?

Now the fun begins! You will enter Stage 1 of the challenge, the evaluation phase. Once the requirements have been met within the first month, you will continue to Stage 2 of the challenge. Traders who successfully pass the initial stages of the challenge will gain access to a Live Trading Account where you can earn 70% of the profits on a Funded Account.

Can I become a Funded Trader?

Most organizations require that traders have some knowledge in trading or has the basic skills at the very least. Most Funded Trader programs have an initial evaluation phase to determine the traders' abilities, once the targets and requirements have been met, the traders would enter a verification phase to see if the traders can continue reaching the target profits over an extended period. Those who succeed in reaching the necessary requirements and have continued to reach the profit targets are eligible for the live Funded Account.

Some organizations offer an immediate Funded Account, but traders may need to pay higher participation fees or meet a different set of requirements.

Do you think you have what it takes? Challenge yourself first with our FREE fun trading Quiz and prove you can make a profit trading while enhancing your trading capabilities!

Choosing the best Funded Trader program for you!

The choice of which Funded Trader program can only be determined by your personal and financial goals. What do you want from the program, what skills and knowledge do you have, do you have what it takes to fulfil the necessary requirements, what is the criteria for joining the Funded Program? These are all the questions you need to ask yourself before diving into this adventure. Once you have established what your goals are, a quick internet search can be done to find the perfect program to suit your needs.

Each organization offers different programs / challenges and they each come with their own set of requirements and criteria’s. They differ according to their parameters; funding limits, minimum profit targets, position size limits, minimum trading days, leverages, maximum daily loss, maximum overall loss, benefits received, pay-out dates, etc.

The Funded Trader account is the perfect option for traders that do not have the initial start-up capital to begin trading but holds the necessary skills and/or knowledge to generate income.

Partnering up with the correct organization and joining to program that best suits your goals could be the answer to securing your financial and trading objectives. Since you will be trading with the company’s funds, the company would require a consistent trading performance and expect you to regularly meet their predetermined requirements. If you do not meet the criteria, your account will most likely be suspended. One of the benefits some firms are offering, is that traders can have multiple Funded Trader accounts at any given moment, therefore, should traders fail to meet the requirements on one account, they still have the option to continue on a different account.

It is also essential to determine what your trading style is and what assets or instruments you would like to trade with whether it is Crypto's, Forex, Indices, Stocks, Energies, Metals, etc, there are so many options to choose from. Once you have established your trading style you can join a program that provides the options you are interested in. At the end of the day the decision is completely yours, but before launching into the trading world be sure to do your research!

And The best way to judge a new car is to take it for a test drive, right? Some Prop Trading firms offer Free trials and their traders given the opportunity to start a free trial on their platform and trade without having to pay any fees making it ideal for practicing your strategies and getting comfortable with the platform.

If you're comparing firm reputations, don't forget to factor in cost. Our updated guide on the Cheapest $100K Prop Firm Accounts breaks down which firms offer the lowest fees without compromising on payout structures or trader support.

As a funded trader, there are several expenses you need to consider and manage effectively to maintain profitability and financial stability. Before we discuss the cheapest prop firm or most cost-effective funded account challenge, in our detailed guide "The Most Affordable Prop Firms - Cheapest trading challenge" you will find everything you need regarding the main expenses you may encounter.

The Best Funded Trader Programs for 2026

Funded trading accounts are a great way to get started with trading or consolidate your trading endeavours, since they can offer traders enhanced access and increased opportunities, while not putting at risk any of their own capital, essentially offering them the best of both worlds. Funded trader programs can be really appropriate for beginner traders to enter the great world of trading, as well as especially suitable for more seasoned private traders to up their game and boost their profits.

If you are intrigued by the prospect of trying out funded trading, it is imperative that you consider what makes a well-funded trader program and also consider the pros of such an arrangement to make up your mind if it is best suited for you. In general, a well-funded trader program would be one that would help you get started through the provision of dedicated and high-quality education, webinars, and support. However, perhaps what is of the utmost importance to look out for is of your trading account partner to be a prop firm that is reputable and trustworthy and of the actual trading to be taking place on a credible and proven trading platform or platforms.

The limited, even zero, risk factor that comes with a funded trader account is perhaps the biggest benefit of such an arrangement, while with access to huge capital traders can really make their trading skills count and meet with unprecedented success and profitability. However, interested traders should be aware that funded trader programs usually come at a fee for access to the trading platform and real-time data.

With this in mind, let us take a look at the funded trader programs, which we consider to be the best available currently for interested traders to choose from:

FunderPro

Founded by a team of traders and investment managers in Dubai in late 2022, FunderPro was established to offer a platform for traders to showcase their abilities without undue pressure or excessive regulations. FunderPro traders have the flexibility to trade at their own pace and for as long as they require, without the burden of deadlines or petty restrictions. FunderPro's guiding philosophy is to empower - not limit - traders.

FTMO

Another provider of funded trading accounts is FTMO, an award-wining prop trading firm, which specializes in forex trading. FTMO has an established track record, having paid out, in 2021 alone, over $23,000,000 to their traders, in very fast processing times of merely a few hours.

To qualify for an FTMO funded trading account, interested traders must complete a process, which comprises 3 steps. The first step entails the sign up for the FTMO Challenge, in which you have 30 days to achieve the set profit goals. If you are successful in this, you then enter a 60-day verification process during which you must prove that you can replicate the success and profit targets reached during the Challenge.

Those successfully completing the first two steps then receive a funded account offer from FTMO, via a funded trading account whose capital ranges from $10,000 up to $400,000. Usually, FTMO offers traders on funded accounts an 80% share of the profits generated, which they may withdraw as they wish. In addition, there is also a scaling plan on offer, under which traders may increase their profit share to 90%, with account sizes as large as $2,000,000.

Another upside of FTMO funded trading account is the large variety of assets from different classes available for trading, with the selection of currency pairs being especially strong, but also including most popular cryptocurrencies, as well as cash indices, commodities, and stock CFDs.

Trading Platforms

Through the FTMO funded accounts, traders get access to coveted trading platforms for free. In fact, users may trade on either of the popular MetaTrader 4, MetaTrader 5, or cTrader platforms.

Credibility

FTMO is a well-known, credible firm, which ranks high on Trustpilot, while also having earned coveted prizes, such as the Technology Fast 50 award by Deloitte. Moreover, the firm is transparent and publicly discloses on its website its head office details in Prague, as well as its registration information.

Costs

For the $10,000 FTMO account, which offers a leverage ratio of 1:100 and thus $1 million in buying power, traders must pay a fee that starts at $139.50. However, this is the only cost to be borne, as there are no additional platform fees or participation fees for the verification process. Moreover, the FTMO challenge fee is only paid once and it is returned back to traders once they achieve their first profit split as funded traders.

Topstep

Topstep Forex offers a coveted trader funded accounts program based on a set of specific eligibility requirements, which entail the successful completion of what is called the Trading Combine phase. During this process, those aspiring to earn access to a funded trading account, must demonstrate their trading skills by showing consistent profitability, effective risk management and an ability to meet the set profit targets, within a specific time period without exceeding the set loss limits.

Those successfully completing the Trading Combine eligibility phase enter the funded trader program and can start trading with zero risk, while taking home a share of 80% of the achieved profits, which they can withdraw at any time.

Trading Platforms

Traders wishing to qualify for a Topstep Forex funded account may use a wide range of different trading platforms, such as TSTrader, TradingView, NinjaTrader, TradeStation and many others, depending on which suits them best.

Credibility

Topstep Forex is the forex branch of Topstep Trader, which is currently considered an industry leader and one of the Inc. 5000 fastest-growing companies in the United States, as such it is a fully transparent, credible company, receiving favorable reviews by users and easily reachable by phone or through its dedicated online help center.

Costs

During the Trading Combine eligibility phase, you will be required to pay $100 every month for access to the smallest trading account which gives you $200k buying power.

OspreyFX

OspreyFX Funded Account Challenge tests your trading ability and rewards you with a funded account, allowing you to trade with zero risk of losing your capital! Traders who successfully pay an entry fee and complete the two initial stages of the challenge will gain access to a Live Trading Account which they will be able to benefit from 70% of any profits earned whilst trading. Before starting the initial stages of the challenge, you will also be provided with the option of selecting the amount credited to your Funded Account (Different fees apply according to the amount selected).

Trading Platforms

Through the OspreyFX funded accounts, traders get access to coveted trading platforms for free and trade on either of the popular MetaTrader 4 and MetaTrader 5 platforms.

Earn2Trade

The Gauntlet Program and the Gauntlet Mini Program are the two different funded trading programs offered by Earn2Trade. Through the regular Gauntlet program, which is focused on trading the Futures market, you initially get to trade through a $25,000 virtual account for 60 days, is required to trade at least once a year and for a total of at least 30 calendar days within the 60-day period. During this period your target is to achieve a 10% profit mark, while at the same time never exceeding the maximum drawdown set at 10%. Once you successfully complete this evaluation period, you are then offered a guaranteed funded trading account, from Earn2Trade’s partners Helios Trading Partners and Appius Trading.

The new Gauntlet Mini program, on the other hand, is more similar to other funded trading programs around and you can access it by paying a set monthly fee provided you comply and abide by its set of rules when trading. The monthly fee allows you access to Journalytix, as well as dedicated webinars and other trading education, to help you improve your skills and knowledge. Successful completion of the evaluation stage in this program as well also results in an offer for a funded trading account being made to you. What is noteworthy about both these programs is the favorable profit split, with the trader getting 80% of profits generated.

Trading Platforms

Another great feature of the Earn2Trade funded trading accounts is that trading can take place in a great number of different trading platforms, such as NinjaTrader, Finamark, R|Trader, Agena Trader, MultiCharts, and many more, which allows traders to choose the one that suits them best.

Credibility

The company behind this funded trading account scheme appears to be rather credible and enjoys a good reputation, scoring high on Trustpilot, based on real reviews. Its registered office is in the city of Sheridan, in Wyoming, USA and they can be contacted via email at support@earn2trade.com.

Costs

The Gauntlet Mini account comes in various amount sizes ranging from $25k to $150k, each carrying a different monthly fee cost, with the lowest starting at $130 per month.

Fidelcrest

Fidelcrest is a relative newcomer in the landscape of trading account providers since it was founded in 2018 by a team of professional forex traders. The firm has grown rapidly and according to the data on its website, it currently boasts more than 6,000 active traders worldwide, being offered the opportunity to trade on more than 1,000 tradeable instruments. To qualify for a funded account, you must first successfully complete the verification phase, the profit share during which is 40%. The profit share rises to 70%-80%, for those achieving the targets set in the verification process.

Trading Platforms

Fidelcrest funded trading account holders, may trade using the MetaTrader 4, MetaTrader 5 or cTrader platforms. Moreover, during the Fidelcrest Trading Challenge and Verification processes, the demo accounts of brokers Fidelcrest Markets, TradeView, IC Markets, XM Markets, Blueberry Markets, Purple Trading, Pepperstone, and RoboForex, may also be used. However, bear in mind that in Phase 1 and Phase 2 of the process, traders must trade the same instruments, but each trading period requires a new account to be set. Thus, it is important to ensure that the instruments one wishes to trade on are supported by their broker in both phases.

Credibility

Fidelcrest Ltd is a firm based in Nicosia, Cyprus, and its company registration and tax details are publicly listed on their website. Moreover, the company may be easily contacted via email at support@fidelcrest.com. Being a relative newcomer there is a small number of reviews on them on Trustpilot, but their rating seems to rank them as a fairly credible firm.

Costs

Fidelcrest offers four different ProFX Normal accounts for forex trading with capital sizes ranging from $50,000 to $400,000. To access those, one needs to pay a one-off evaluation fee, which ranges from $349 to $1,499. However, the firm also offers ProFX Aggressive accounts, as well as accounts of smaller sizes, with the fee being adjusted accordingly.

The5ers

The5ers is a funded trading account provider, which applies different rules than most other providers, since all funded trading accounts are live accounts funded with real money by The5ers, for subscribers to trade through. Each interested trader must first successfully complete a Level 1 program by achieving profit targets ranging between 10% and 25%. The Level 1 program is closed upon its successful completion, the profits achieved are paid out and a new trading account must then be opened. The tradable instruments include all the popular major forex currency pairs. The profit split for the The5ers funded accounts is set at the 50:50 ratio, which is lower than other programs.

Trading Platforms

The particular funded trading programs are hosted on the popular MetaTrader 5 trading platform.

Credibility

The5ers appears as a credible and transparent company, headquartered in Israel and also having offices in London, and they can be easily contacted via email or telephone. Moreover, it ranks high on Trustpilot based on the reviews posted by real users.

Costs

The participation fee for the funded trading program ranges from $275 to $875, depending on the account size.

City Traders Imperium

City Traders Imperium was established in 2018 and it is based in London, UK. Its funded trader program for forex trading is a new addition to its offering and it gives out profit shares ranging from 50% to 70%. Interested traders are free to use any trading strategies they wish and have one year to successfully complete the evaluation phase and be qualified to proceed to the Portfolio Manager level. During the Evaluation phase, traders may also trade in gold and forex pairs, while at the portfolio manager level indices are also added to the list of tradeable instruments. Interested traders should be aware that the firm also offers a rather complex scaling plan and the entire program is governed by strict risk management rules, including mandatory stop-loss orders.

Trading Platforms

The only trading platform available for traders is the popular MetaTrader 4 platform.

Credibility

City Trader Imperium appears as a trustworthy and transparent firm, which can be easily reached via email and whose website fully lists their company address and registration details. Moreover, it ranks high on the Trustpilot rating, based on real reviews by users.

Costs

Being a UK-based firm, the account sizes offered and fees due are in GBP. Account sizes range from $2,500 to $17,500, and based on the account size, a one-time fee must be paid, which ranges between £109 and £649.

Compare Funded Trader Accounts Programs - Find the best Prop Trading firm for you

List of some of the best Prop Trading firm in 2026 to help you to get startedProp Trading Firms at a glance

A handy comparison table with all the key facts for the world's top Funded Trader Accounts Programs.

Comparison table that allows users to easily see and compare multiple important attributes of Top Prop Trading Firms at a glance. Funded Trader Program Tradeable Assets Your Profit Share Free Trial Discount FunderPro Forex, Crypto 80%-90% 20%-45% Earn2Trade Futures 80% 20%-50% FTMO Forex, Crypto 80%-90% Fidelcrest Forex 40%-70% The5ers Forex 50% City Traders Imperium Forex, Gold, Indices 50%-70% What do you need to know before becoming a Funded Trader?

To be successful in this program, you need to treat the funded capital as if you were investing your own funds into the program. Just because you are not emotionally attached to the funds and you did not need to invest your own capital, does not mean you can take advantage of the funds and trade irrationally. The main objective of the program is to earn your share of the profits, in order to do that you need to reach a certain profit target. If the targets do not get reached, you will lose the account and therefore you will not generate any income.

The next thing to consider when signing up, is to choose the correct program. Make sure you do the research and get familiar with the program’s criteria, profit targets, the profit share you can earn, the daily loss limit as well as the overall loss limit. Make sure you read the terms and conditions and check the trading platform you will be trading on to make sure you are familiar with it.

In conclusion, you have the opportunity to build a professional trading career without putting down the substantial capital needed so make sure you do the proper research a lay down a solid foundation.

Pros and cons of being a funded trader

Like everything in life, becoming a Funded Trader has its advantages and disadvantages. It is important to keep your options open and examine what the third-party has to offer before deciding on the Proprietary Trading Firm and the Funded Account program that is best for you. Below is a list of what we believe are the pros and cons of being a funded trader.

The pros of a funded Forex account

- Risk-free trading without risking your own capital.

- Community of traders at your disposal to enhance your trading knowledge and skills.

- You earn a percentage of the trading profits you generate and do not pay for the losses.

- Zero or low-cost to get started.

- Freedom to work remotely at your own pace.

The cons of a funded Forex account

- Should you not meet the requirement, the account can be closed.

- You must trade according to their rules and timeframes. These include daily loss limits, overall loss limits etc.

- Initial stages and requirements must be met before becoming a Funded Trader.

- Only working on the assigned trading platform.

- Split the profits with the trading organization.

Observations

Working remotely is just another one of the advantages of becoming a Funded Trader. It provides the freedom and opportunity to work anywhere at your own leisure, provided you have a laptop and a stable internet connection, whilst the biggest advantage remains the fact that you can-do risk-free trading without losing your own capital. However, individual traders risk losing their own funds due to slippage and margin calls, thus needing to have sufficient initial start-up funds to sustain the loss.

Funded traders are provided with a start-up capital and is given the opportunity to receive income from the profits they generate. It goes without saying that the company providing the capital would have some terms and conditions attached. Any trading company would expect that you continually generate consistent profits and deliver a high trading performance.

With most Funded Trader Accounts, you are not automatically gifted the capital to start trading, you have to follow the process of signing up and going through the initial evaluation and verification phases to prove you can generate profits over an extended period of time before receiving the Funded Account. If you fail, you will not be reimbursed for your time and effort and your account will be closed, in which case, you will need to start all over.

The best program for you would solely be dependent on your personal needs, trading goals and the time you must dedicate yourself to the task. This is the best option for you if you do not have initial capital to start trading, but you have the trading abilities to generate profits.

Remember, you have the opportunity to earn a share of profits on a Funded account, risk free without any capital. If you have great trading acumen, you have nothing to lose except time.

Are you ready to kickstart your trading career and become a successful Funded Trader? The trading community is ready for you!

Help Me Choose A funded trading account

We are happy to provide all traders with this "Help Me Choose A Funded Trader Program" special service 100% free so that you can find the best trading account program that a Prop Trading Firm is providing to meet your needs. All you have to do is fill in some information in the few easy steps below and we will connect you with the Prop Trading Firm that is most compatible for you.

Prop Trading Firms and Funded Trader accounts FAQs

The Funded Trader opportunity has become quite popular in the trading industry, that is why we thought it best to have a look at some frequently asked questions regarding the Funded Trader account:

A funded trading account is a proprietary trading account that enables qualified traders to trade on behalf of a Prop Trading Firm and operating with firm’s capital without putting their own trading account at risk.The Funded Trader program is for trader’s that have some level of trading experience but lack the capital to start their trading career.Most funded trader programs have an initial evaluation phase to determine the prospective funded traders' abilities. Once the targets and requirements have been met, the traders would enter a verification phase to see if the traders can continue reaching the target profits over an extended period. Those who succeed in reaching the necessary requirements and have continued to reach the profit targets are eligible for the live funded account.In a nutshell, a funded account means trading with a proprietary trading account on behalf of a company. That means you will trade using the company's funds and you do not have to fund your own account or pay fees and commissions to a broker. However, you will have a certain percentage taken from your gains by the Prop Trading Firm.Funded trader programs as a business model are not a scam and it is possible for traders to get funded with large amounts of money. However, there is an abundance of companies offering forex funded accounts and not all of them are safe (they benefit more from fees from customers who can never pass their tests than from funded traders), thus prospective traders need to perform due diligence and adequate research before applying for a funded trading account. Investors should prefer Prop Trading Firms which enjoy a good reputation.Concluding your search for the best prop forex firm it requires thorough research and evaluation of several factors. It is essential to consider factors mainly based on profit splits, total or maximum funding possible, assets they trade in, evaluation process, duration, and promotion criteria.To be able to determine the best company offering forex funded accounts you need to study, learn and compare their offering in its different facets and set them against each other to establish which is best and which better serves and caters to your own needs. Each organization offers different programs/challenges and they each come with its own set of requirements and criteria. They differ according to their parameters; funding limits, minimum profit targets, position size limits, minimum trading days, leverages, maximum daily loss, maximum overall loss, benefits received, pay-out dates, etc.The organization offers an account fully funded; however, the organization would need to retrieve the funds back in some way. This is done by taking a percentage of the profits earned on the Funded Trader account. The percentage of the profits being split varies between programs. Some organizations only take 20% of the hard-earned profits and some take 50%. It is best to do research on what share the organization will keep before signing up.Each organization has some sort of risk management strategies in place; therefore, it would not be possible to lose all the funds. Your account will be closed if you reach a certain percentage of overall loss on the total capital. Once again, the percentage differs between organizations, some have a max overall limit of 10% of the total capital and some has a limit of 15%. Rest assured you will not need to compensate the organization for the losses.Some trading organizations require an entry fee based on the program you select; however, they offer a higher share of profit for the trader to keep. Other organizations do not require any start-up or entry fees; however, they might offer a lower percentage of the profits for the trader to keep. Apart from the entry fee, there should not be any other initial start-up fees.The simple answer is, you need to trade, however, there is more to it. You need to use your trading capabilities to reach a certain profit target over a period of time to receive your share of the profits. You also have limits on the daily and overall percentage of losses. The main responsibility of the Funded Trader is to reach the profit targets and avoid reaching the loss percentages.

Related Posts

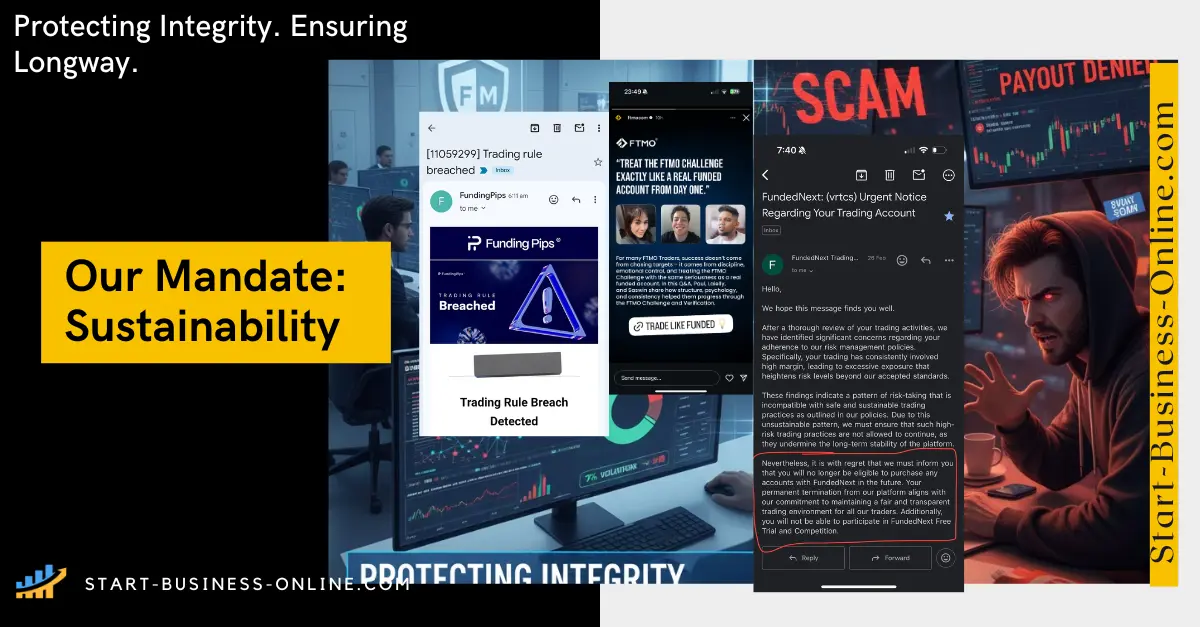

Prop Firms, Trustpilot and “Breach of Guidelines” Warnings

In the prop-firm boom, Trustpilot has become one of the first places traders look before buying a challenge. A long list of five-star reviews can feel like a ...

Prop Trading Thailand: Best Firms, THB Costs, SEC/BOT

Prop trading in Thailand is moving from niche to mainstream as traders in Bangkok, Chiang Mai, and Khon Kaen look for scalable capital, disciplined rulebooks, and ...

Filter vs. Betrayal: Analyzing the Prop Firm Reckoning

⚔️ The Great Filter vs. The Great Betrayal: Analyzing the Prop Firm Reckoning Executive Summary At-a-glance overview FocusCore ConflictKey Data ...

Prop Trading in Vietnam: Rules, Costs (VND), SSC/SBV, & Payouts

Prop trading in Vietnam is quietly moving from niche to notable. Traders from Ho Chi Minh City, Hanoi, and Da Nang are turning to prop evaluations (thi quỹ ...