In the prop-firm boom, Trustpilot has become one of the first places traders look before buying a challenge. A long list of five-star reviews can feel like a safety net – especially if you’re about to drop several hundred dollars on a 100K or 200K account.

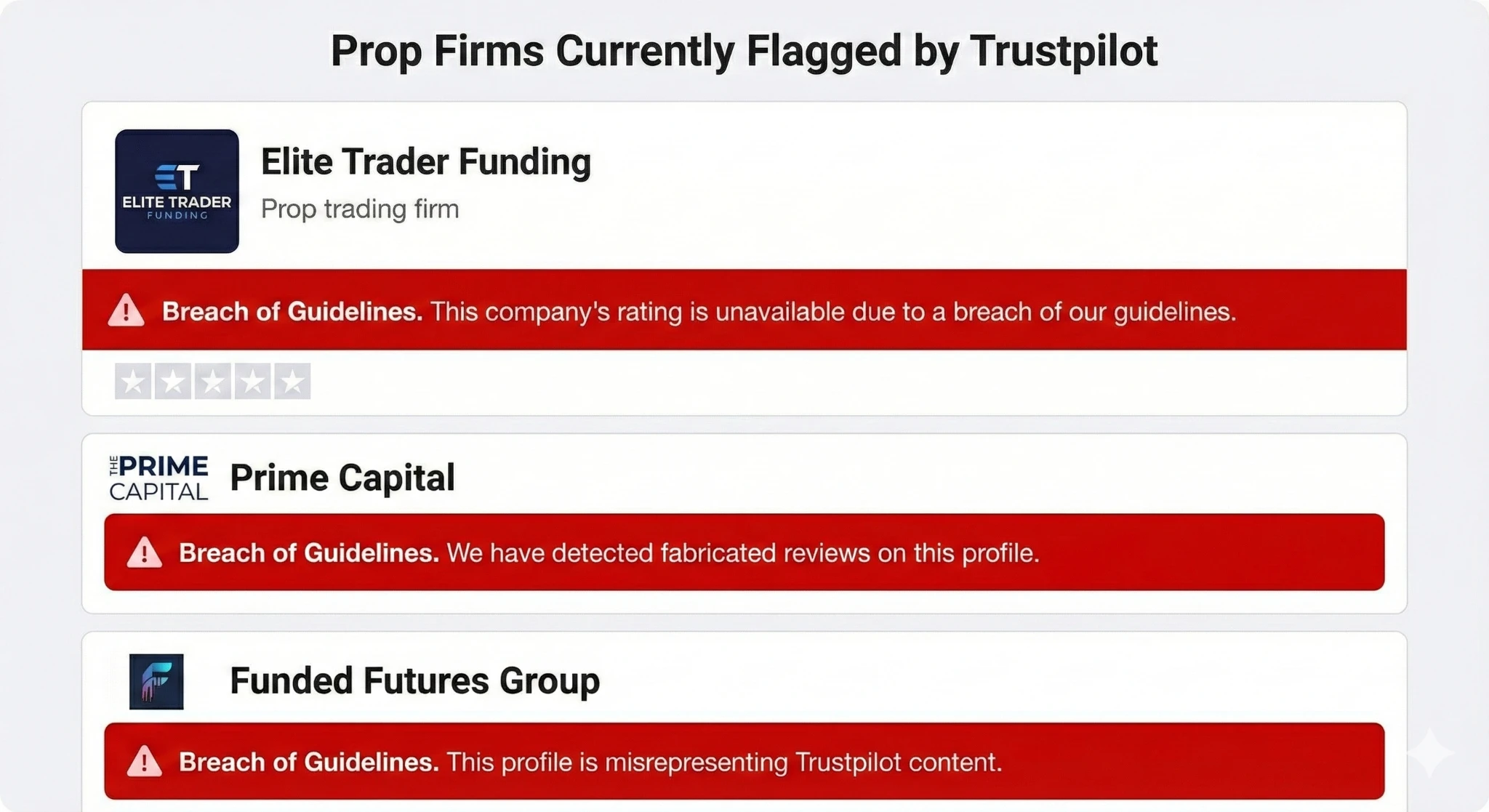

But in 2026, a growing number of prop firms (and prop-adjacent services) now carry a red banner on Trustpilot that reads something like:

“This company’s rating is unavailable due to a breach of our guidelines.”

For traders, that line is a big deal. It means Trustpilot itself believes something is wrong with how reviews are being collected or how its brand is being used – often involving fake reviews, incentives, or misleading use of Trustpilot widgets.

This article explains what those warnings actually mean, highlights key prop firms currently affected, and shows you how to use these signals as part of serious due diligence – alongside the usual metrics like drawdown rules, pricing per $1k, payout schemes and challenge difficulty.

Why Trustpilot Matters in Prop Trading

If you think a 4.8-star rating on Trustpilot guarantees your payout, you are trading on outdated data.

Prop firms are lightly regulated compared with traditional brokers. Many are registered as “alternative financial services” or even simple educational companies. That makes social proof incredibly powerful: a wall of positive reviews can easily sway new traders who don’t have the tools to read legal documents or dig into corporate structures.

At the same time, fake reviews have become an industry in their own right. Investigations into online review fraud show that some investment and trading brands actively buy five-star reviews or use networks of fake profiles.

Trustpilot itself says it uses AI and manual investigations to detect this behaviour, and that it removed a meaningful percentage of all submitted reviews in a recent year for guideline breaches. When the platform detects systematic manipulation or misuse for a particular company, it can go further and place a prominent red warning on that profile – the “breach of guidelines” message you’re seeing on several prop firms today.

What “Breach of Guidelines” Actually Means

Trustpilot’s guidelines cover both reviewers and businesses. A “breach of guidelines” warning usually falls into one (or more) of these buckets:

- Fake or manipulated reviews – patterns of suspicious five-star ratings, review farms, multiple accounts posting similar text, or obviously non-genuine feedback.

- Incentivised reviews or review gating – companies offering discounts, payouts or other benefits in exchange for positive reviews, or asking only “happy” users to post on Trustpilot.

- Misleading use of Trustpilot content – for example, showing outdated scores, cherry-picked reviews, or fabricated Trustpilot widgets on their own website.

When Trustpilot finds enough evidence, it can:

- Remove large numbers of reviews it considers fake or incentivised.

- Temporarily or permanently hide the TrustScore for that company.

- Display the red banner explaining why the rating is unavailable, often with a short note like “we’ve removed a number of fake reviews for this company” or “this company is displaying Trustpilot content in a misleading way”.

Crucially, a breach warning doesn’t automatically prove that a prop firm won’t pay traders. But it does tell you that the public review footprint has been significantly distorted – which means you can’t treat the TrustScore at face value, and you should be much more cautious with your capital.

Prop Firms Currently Flagged by Trustpilot

As of 2026, several prop firms and prop-related services have active “breach of guidelines” warnings on their Trustpilot pages. Below are examples grouped by the type of issue Trustpilot highlights. This is a snapshot, and statuses can change at any time – always re-check profiles directly before you act.

Firms flagged for fake or suspicious review activity

- Blue Guardian – Trustpilot states that the company’s rating is unavailable due to a breach of guidelines, and that a number of fake reviews have been removed.

- AquaFunded (Aqua Funded) – carries a red banner saying the rating is unavailable after a breach of guidelines; reports note that fake or non-genuine reviews were removed and the profile no longer shows an active TrustScore.

- Hola Prime – Trustpilot removed a large block of reviews it considered fake and replaced the usual TrustScore with a breach-of-guidelines warning.

- AudaCity Capital (Audacity Capital) – one of the longer-running prop firms; public coverage describes a major purge of fake reviews followed by a “breach of guidelines” notice on its profile.

In all of these cases, the key takeaway is that review volumes and scores you might see quoted elsewhere (e.g. on a firm’s homepage) may no longer reflect the current, cleaned-up reality.

Firms flagged for incentives and review gating

On several prop firms, the breach banner appears together with a standard line from Trustpilot:

“Companies on Trustpilot aren’t allowed to offer incentives or pay to hide reviews.”

You’ll see this combination on firms such as:

- GoatFundedFutures – rating unavailable due to a breach of guidelines; the profile emphasises that companies cannot offer incentives or pay to hide reviews.

- Finotive Funding – active prop firm whose Trustpilot page notes that the rating is unavailable because of a guideline breach, again accompanied by the standard warning about incentives and review hiding.

- FundedX – profile shows that the rating is unavailable due to a breach of guidelines, with the same incentives/hiding-reviews disclaimer underneath.

- TigerFunded – Trustpilot indicates the rating is unavailable because of guideline breaches, again referencing incentives and paying to hide reviews.

- WeMasterTrade – education/copy-trading ecosystem strongly tied to funded accounts; its profile carries the breach-of-guidelines banner and the incentives/hiding-reviews message.

These banners don’t tell you exactly what behaviour occurred, but they strongly suggest that Trustpilot found either incentivised reviews, unfair suppression of negative feedback, or both.

Firms flagged for misleading use of Trustpilot branding

Another category is where Trustpilot says a company is misusing its logo, widgets or rating in a misleading way, for example by showing doctored scores or old data.

- Furex Capital – listed as a prop firm; Trustpilot’s breach note reads that the rating is unavailable because the company is displaying Trustpilot content in a misleading way.

- FX Expert Funded – funding program whose profile similarly states that the rating is unavailable because the company is displaying Trustpilot content in a misleading way.

- The Trading Capital – an educational/investment brand with overlap into trading; Trustpilot shows the same “displaying Trustpilot content in a misleading way” breach message.

- Some other investment brands (not pure prop firms) also carry this specific wording, reinforcing that misuse of the Trustpilot logo and widgets is treated very seriously.

For traders, this is an extra red flag: if a firm is already misrepresenting something as simple as its review score, how comfortable are you trusting its marketing around payout speed, slippage, or risk rules?

The TrustScore “house of cards”: economics of fake reviews

In your social feed, the red “Breach of guidelines” badge can look like a small UX detail. In reality, it’s closer to a digital scarlet letter. When a firm loses its public TrustScore, it isn’t just a cosmetic hit; it’s the collapse of a carefully engineered reputation stack.

Why would companies risk that? Because the economics of fake reviews are brutally simple:

- Review farms scale cheaply. A business can buy large batches of five-star reviews from so-called “click farms”, often for less than the cost of a single properly handled customer complaint.

- Incentive programmes feel harmless. “Leave us a 5-star review for 10% off your next challenge” sounds like marketing, but it quietly distorts the whole TrustScore.

- Review gating filters out unhappy traders. Some firms push only satisfied clients to Trustpilot while routing angry traders to private tickets or off-platform chats, so the public rating never reflects actual dispute rates.

Across ecommerce and financial services, studies and enforcement cases show that an extra star of rating can deliver a double-digit uplift in conversion, and that the revenue generated by fake reviews can be many times higher than what the business spent to acquire them. In other words, the short-term ROI of manipulating reviews can look fantastic – right up until a platform like Trustpilot steps in, deletes the fakes and stamps a breach warning on the profile.

That’s the context for the recent clean-up wave in the prop space. We’re not just seeing a few bad actors exposed; we’re watching a wider “5-star era” begin to crack as platforms tighten enforcement and regulators start treating fake reviews as a form of financial mis-selling.

How Traders Should Interpret These Warnings

It’s tempting to see a breach-of-guidelines warning and immediately label a firm a “scam”. Reality is more nuanced. Some firms with warnings still pay on time and have real traders with good experiences; others may combine aggressive marketing, unclear rules and a weak risk culture.

Here’s a balanced way to interpret the red banner:

- Treat the TrustScore as compromised. Once fake or incentivised reviews are removed, the historical score becomes unreliable. Don’t use the star rating as a primary decision input.

- Assume selection bias in remaining reviews. Even after clean-up, you’ll often see polarisation: angry 1-star reviews from denied payouts versus glowing 5-stars from fans or affiliates.

- Re-weight your analysis toward hard rules and data. Focus on things the firm can’t hide as easily: max drawdown, trailing vs static equity rules, consistency requirements, scaling policy, and actual payout proof from independent sources.

- Check whether the breach directly relates to your risk. Incentivised reviews and misleading widgets are reputational, but systemic fake reviews combined with payout disputes in the comments are much more worrying.

This is exactly why we always pair review analysis with quantitative challenge comparisons – price per $1k of buying power, daily and overall drawdown, evaluation steps, and payout conditions – in our prop-firm guides. Reviews can show you how rules play out in the wild, but they’re never a substitute for reading the fine print.

Due-diligence checklist for prop firms in 2026

Here’s a practical workflow you can use whenever you research a prop firm on Trustpilot:

- Open the Trustpilot page and look only at the banner first.

- No banner: proceed, but still be sceptical of perfect scores.

- “Breach of guidelines” banner: note the reason (fake reviews, incentives, misleading content) and downgrade the weight you give to the TrustScore.

- Scan the most recent 20–30 reviews.

- Look for clusters of 1-star complaints around payout denials, hidden rules or sudden breaches.

- Watch for copy-paste style five-star reviews with generic praise and little detail.

- Notice reviews mentioning being offered discounts, refunds, or bonuses in exchange for feedback.

- Cross-check with independent coverage.

Search news and community posts for the firm’s name plus “Trustpilot” or “reviews” to see whether there have been reports of fake reviews being removed or of major disputes. - Now evaluate the challenge itself.

- Max total drawdown (equity vs balance based).

- Daily loss limit and whether it uses equity or balance.

- Profit targets per phase and number of steps.

- Payout split, first payout timing, payout frequency.

- Refund and coupon structure versus true “all-in” cost.

- Size your risk accordingly.

- If a firm has both a breach-of-guidelines warning and aggressive rules or lots of payout disputes, then treat any challenge fee as money you can fully lose.

- Consider starting with the smallest account or avoiding the firm entirely in favour of more transparent alternatives.

The Trader’s Due Diligence Checklist 2.0

From a practical trading perspective, you can boil all of this down into three quick “tells”:

- The Incentive Trap. If a firm offers you a discount or extra capital in exchange for a 5-star review, especially before you have received a payout, treat that as a major red flag.

- The Generic Praise Pattern. When most of the positive reviews are vague (“best firm ever”, “amazing support”) and light on specifics about rules, spreads or payout timelines, assume you’re looking at low-quality or coached feedback.

- The Red Banner Check. Before buying any challenge, scroll past the stars and look for the “Breach of guidelines” box. If you see it, the firm is effectively trading under a cloud – price that risk into your decision.

Using Trustpilot Without Being Gamed

Trustpilot is still useful for prop traders – but only if you understand its limitations.

- Use it as a starting point, not a green light. High scores can be engineered; red banners are harder to fake.

- Read reviews like an auditor. Extract factual claims (“my payout was delayed 30 days”, “they applied a hidden rule about news trading”) and cross-check them with the terms and conditions.

- Give more weight to older reviews that pre-date major promotions. Sudden spikes of five-star feedback around coupon campaigns or influencer pushes are often the dirtiest.

- Combine qualitative and quantitative analysis. Once you’ve factored in Trustpilot warning banners, go back to the numbers – evaluation model, drawdown, risk rules, scaling – and ask whether the deal still makes sense compared with other firms that haven’t been flagged.

In other words, your goal as a trader is not to find the firm with the prettiest Trustpilot page. It’s to find a firm where:

- The challenge rules are fair and clearly written.

- The pricing per $1k of buying power is competitive.

- Payouts are consistent and verifiable.

- And the public review footprint hasn’t been so heavily manipulated that you’re flying blind.

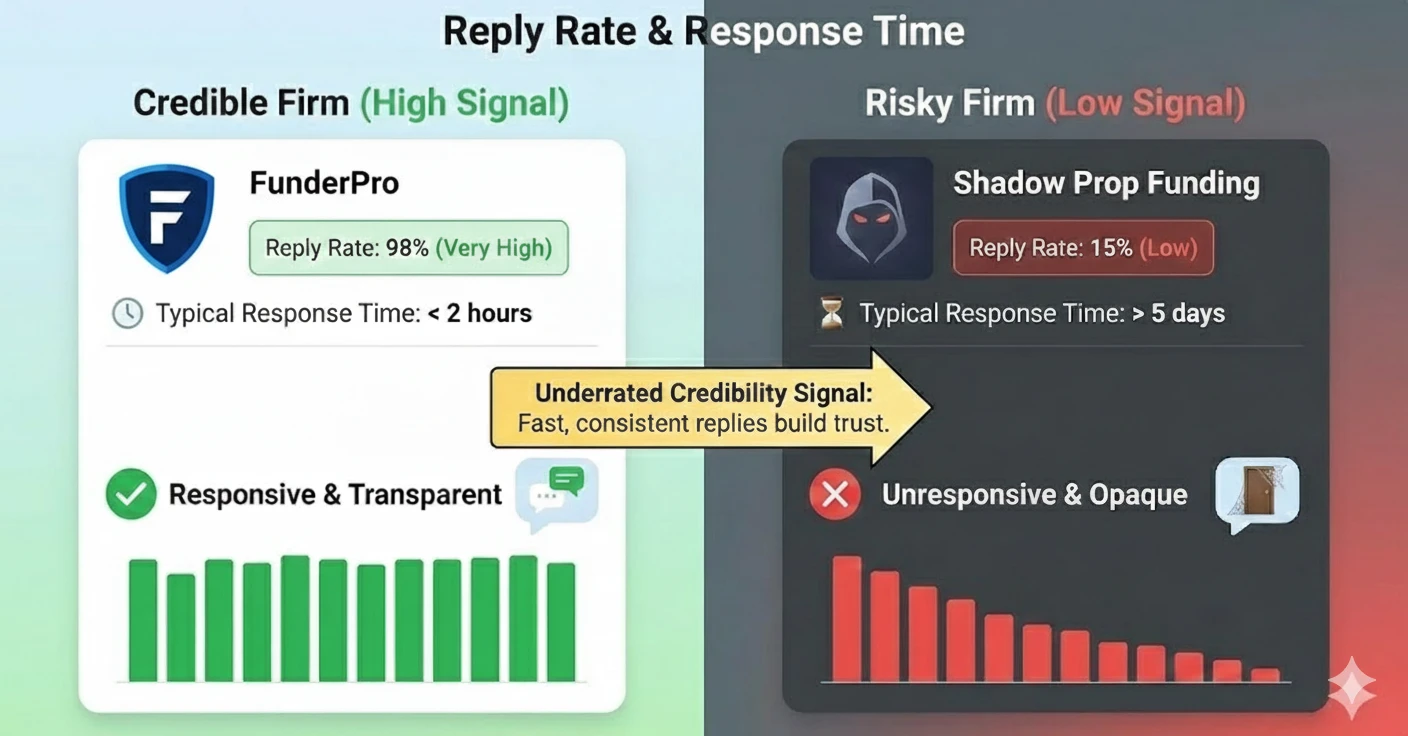

Reply rate & response time: an underrated credibility signal

One Trustpilot element traders often ignore is the small box under the stars that says something like: “Replied to 98% of negative reviews – Typically replies within 24 hours.” This is more than a vanity metric; it’s a live signal of how seriously a company takes customer issues once things go wrong.

In the prop-firm world that matters because most real disputes show up as negative reviews: denied payouts, surprise breaches, overnight spreads, news restrictions, or slippage on high-frequency strategies. A firm that quietly ignores those reviews is effectively signalling, “we don’t mind public complaints”. A firm that replies to most of them – and does it quickly – is at least engaging with problems in the open.

Here’s a snapshot of trading and prop-funding brands that, at the time of writing, show strong reply rates to negative reviews on Trustpilot:

| Prop firm | Listed on our Best Prop Firms page? | Share of negative reviews replied to* | Typical reply time* | Why this matters for traders |

|---|---|---|---|---|

| FunderPro | Yes – core pick (CFD) | ≈98–99% of negative reviews | Within 24 hours | One of the strongest reply profiles on Trustpilot; almost every negative review gets a public answer within a day, showing a clear process for handling disputes. |

| Funding Pips | Yes – top “instant” option | ≈92% of negative reviews | Within about 1 week | High engagement on complaints for an instant-funding model, which is important where traders worry about slippage, spreads and news restrictions. |

| the5ers (The 5%ers) | Yes – long-running forex prop | ≈90–95% of negative reviews | Typically within 1–2 weeks | Strong reply rate on a large review base; even when traders are unhappy, the firm usually responds, which supports its “long-term growth” branding. |

| SabioTrade | Yes – futures & FX funded accounts | ≈99–100% of negative reviews | Within 48 hours to 1 week | Almost every negative review is answered, often within a couple of days. That level of responsiveness is rare for a mid-size prop firm. |

| Hola Prime | Yes – instant funding & multi-phase | ≈80% of negative reviews | Within about 1 week | Not perfect, but well above average. For a fast-growing prop, replying to most public complaints is a positive signal on transparency. |

*Snapshot based on the live Trustpilot widgets at the time of writing. Always check each profile directly for the latest figures – reply rates and timings can change as firms improve (or neglect) their support.

When you’re comparing prop firms, build these reply metrics into your workflow:

- Green zone: firms that reply to roughly 80–100% of negative reviews within a week or less. This doesn’t guarantee you’ll win every dispute, but it shows the company doesn’t abandon public complaints.

- Amber zone: firms that reply to some negative reviews, or respond very slowly. Treat this as a sign that support may be overwhelmed or selective.

- Red zone: “Hasn’t replied to negative reviews.” If you see this on Trustpilot – especially combined with payout disputes in the comments – treat any challenge fee as money you can fully lose.

Fast, consistent replies don’t guarantee you’ll always win a dispute – but silence in the face of public criticism almost guarantees you won’t.

Final thoughts

The red “breach of guidelines” bar on Trustpilot is one of the clearest risk signals you’ll see in the modern prop-firm ecosystem. It doesn’t prove that a prop firm is automatically fraudulent, but it does prove that something serious has gone wrong with its review profile – usually involving fake, incentivised, or misleading use of Trustpilot content.

For serious traders in 2026, the playbook is simple:

- Always check Trustpilot and note any breach banners.

- Use those warnings as a trigger for deeper research, not a final verdict.

- Pay attention to how often – and how quickly – the firm replies to its negative reviews.

- Anchor your decision on solid challenge metrics, risk-management rules and independently verified payouts – not just star ratings.

If you combine that approach with the kind of quantitative challenge comparisons we already publish (pricing per $1k, max drawdown, evaluation steps and payout terms), you’ll be far less likely to be fooled by manufactured reputations – and far more likely to choose prop firms that can actually support a long-term trading career.