The internet is currently rapidly filling up with Prop firms seeking out traders, thus making it difficult and challenging for new traders to select the right Prop firm amidst a multitude of options. In a nutshell, a Prop firm is a company that provides traders with capital to trade with, with the expectation of earning a percentage of the profits in accordance with the company's terms and conditions. The advantage of trading with Prop firms is that traders can achieve higher returns because of the increased trading capital, which allows for a better profit margin even with lower risk.

However, many traders often make the mistake of not thoroughly researching the criteria required to manage a Prop firm account successfully, resulting in the loss of their account soon after they manage to acquire it. With so many companies offering seemingly attractive deals and benefits, it is tricky and challenging to decide which firm to choose, making it essential to do comprehensive research before committing.

Page Contents

- 1. Proprietary Trading Firm - Everything You Need To Know About

- 2. What does a Prop Trading Firm do?

- 3. Advantages of trading for a remote prop firm

- 4. Are prop firms legit and how do they make money?

- 5. Why are prop firms not regulated?

- 6. How to Become a Funded Trader

- 7. Defining Your Goals

- 8. What to look for when choosing the right prop firm?

- 9. Regulation and Safety for Traders

- 10. Determining the Legitimacy of a Prop Firm

- 11. How to Identify a Shady Prop Firm

- 12. Other Factors to Consider when Evaluating and Selecting a Prop Firm

- 13. Can I be a successful proprietary trader through manual trading?

- 14. Is it possible to earn money with prop firms?

- 15. The Safe Way To Use Prop Firms

- 16. How to Profit from Prop Trading Firms

- 17. Final Thoughts

- 18. FAQs on Proprietary trading

View more

The forex trading world can be a daunting place, with a plethora of options available. There is no one-size-fits-all solution, and selecting the right Prop firm is critical to a trader's success. In 2023, if you don’t want to miss out on what could be a great opportunity for you and your forex trading plans, then choosing the right prop firm is essential, and we are here to help guide you to decide smartly and wisely. Before diving into trading forex online, it is crucial to take the time to learn and understand the essential factors that will enable you to make an informed decision when selecting a prop firm.

Proprietary Trading Firm - Everything You Need To Know About

As we have mentioned above, with so many prop trading companies it is tricky to decide which firm to choose. In this guide, we'll break down everything you should look for in your ideal prop firm. But first, let's get all the background needed.

What does a Prop Trading Firm do?

The first essential step would be to understand what prop trading firms are and what it is that they do differently than other market players. A Proprietary Trading Firm, commonly referred to as a Prop Firm, is a financial institution that utilizes its own capital to trade for its own benefit. Some Prop Firms take this concept one step further by allocating funds to retail traders, allowing them to trade on the company's behalf. Traders are granted access to company funds and can trade in a variety of markets, including stocks, currencies, cryptocurrencies, and commodities, among others, as they see fit.

Prop Firms can either be online brokers or more traditional trading companies. Typically, they receive a portion of the profits, with the defined split potentially ranging from as low as 20% for the broker and 80% for the trader. Proprietary trading, with a particular focus on retail investors, has been gaining in popularity due to the lucrative opportunities it provides.

Not every market participant can afford to invest $200,000 in their trading account, but this isn't an issue for a Prop Firm with ample resources that can provide access to financial markets to literally every person from all over the world! It's worth noting that Prop Firms are utilizing their capabilities to help traders achieve their dream job. Managing a fund doesn't necessarily require one to go to Wall Street, intern for a year, and hope for an offer. A more accessible way to manage hundreds of thousands of dollars is to become a funded trader. However, although this is a more straightforward way towards trading success, it's not without its challenges.

Advantages of trading for a remote prop firm

Choosing a prop firm to trade with is an important decision that can determine your success or failure in trading. One of the first things to consider is whether to trade in-office or remotely. While some traders prefer the in-office option, many opt for remote trading as it provides greater flexibility, while coming with several other advantages, which are discussed further below.

Remote trading for small prop firms offers several advantages, including a small participation fee that is typically required of traders. This fee is usually lower than the amount required to invest in the financial markets independently, and while there may be restrictions on the amount of funds you can access, the cost savings are significant.

Another significant advantage of trading with a remote prop firm is the ability to increase your trading capital quickly. If you are looking to invest more in the markets, trading for a prop firm is an easy way to increase your capital. By trading with the firm's funds, you will have access to greater market buying power, which translates into more significant profits. In addition, if you are consistent in your trading, the prop firm may offer you access to even more capital.

When trading with a prop firm, you get to take home your profits. This is a significant advantage for any trader, as it is not always guaranteed when trading with your funds, especially if you do not have a lot of money to invest. With the additional capital provided by the prop firm, you can earn more and see your profits grow. And because the profits are earned with the firm's funds, they will be divided and added to your account accordingly.

Perhaps the most significant advantage of trading with a prop firm is that you do not have any liability for losses. This is a major relief for traders, especially those who are new to the markets. When trading with your funds, any losses incurred are your responsibility. However, with a prop firm, you can trade with confidence knowing that you will not be held accountable for any losses that may occur. Prop firms have predefined loss limits that traders can take up, so you can trade with peace of mind, knowing that your losses are capped.

In the world of proprietary trading, professionalism, and reliability are essential traits that top-quality prop firms look for in traders. To ensure that traders comply with these values, firms set up structured trading and risk management plans that are strictly monitored. Failure to adhere to these plans puts the trader's account at risk, even if they are successful.

Experienced and senior traders provide guidance and supervision to help traders navigate the markets and achieve their trading objectives. While prop traders are expected to adhere to specific trading parameters defined by the firm, they are still allowed to use a variety of trading strategies, including day trading strategies, as long as they remain within the defined parameters. It's worth noting that these parameters can vary between different firms, but their existence across the board is another distinct advantage of trading through a prop firm, rather than going it alone.

Online prop firms operate 24/7, giving traders the flexibility to choose their trading hours and implement their own self-determined strategies and trading frequencies. This setup allows traders to strike a balance between their work and personal life by not being constrained to specific working hours.

Are prop firms legit and how do they make money?

Prop firms are legitimate businesses that offer trading accounts to successful traders, who pass a rigorous evaluation process. These firms have specific requirements and limitations that traders must follow, such as a profit target, a drawdown limit, and a time limit, to ensure that they only work with the most successful traders who are unlikely to incur significant losses. Prop firms also collect fees from their traders, including evaluation fees and live trading fees, which help to ensure that even a failed trader can still be profitable for the company.

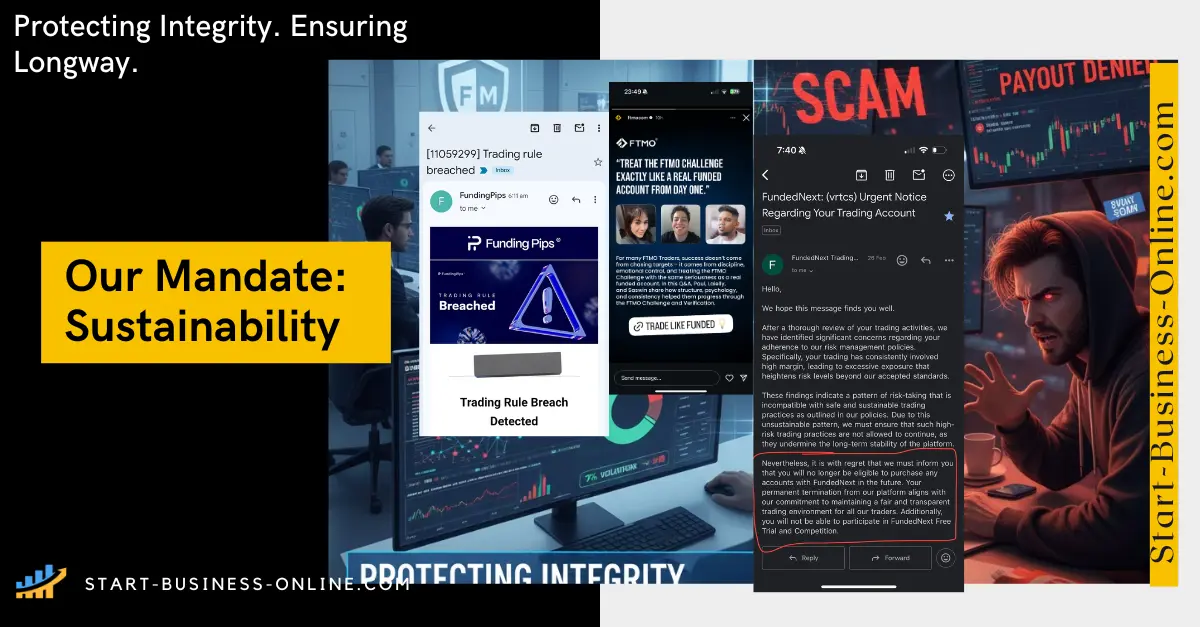

While most prop firms are legitimate, there are still bad actors in the industry. Because there is very little regulation in this area, anyone can start a prop firm and start accepting money for trading challenges. However, sticking to well-known firms, such as FTMO and My Forex Funds, is generally safe, as thousands of prop traders have trading accounts with these firms and are mostly satisfied with their experiences.

Forex and futures prop firms offer traders substantial-sized trading accounts if they can demonstrate their profitability. Typically, this starts with a challenge on a demo account where the trader has to make a certain percentage return. If the trader is successful, they can receive a funded prop trading account and a profit split going forward. While the term "prop firm" has received a bad reputation due to proprietary trading desks at big banks, most prop firms are legitimate businesses that provide a valuable opportunity for skilled traders to access more significant amounts of trading capital.

Why are prop firms not regulated?

The question of why prop firms are not regulated is a complex one, but it boils down to the fact that they are dealing with their own money and not someone else's. Unlike Forex brokers, prop firms are not handling clients' funds, which allows them to avoid many of the regulations and obligations that come with it. Additionally, some prop firms only provide traders with access to virtual capital even after passing an evaluation and gaining access to a "live" account, which technically means that no financial transactions are taking place. Prop firms often present themselves as providing "financial education" rather than financial services, which some regulators may find questionable but are still within the bounds of the law, although there may be attempts on behalf of regulators to change this in the future.

While the lack of regulations may make it simpler and cheaper to get funded by prop firms, it also means that traders have limited protections and are largely on their own when it comes to deciding which prop firms to trust. The lack of oversight and accountability could leave traders vulnerable to fraud or other malpractices. While it is possible that new legislation will demand regulation of Forex prop firms in the future, for now, traders must carefully evaluate each firm and its practices to ensure their safety and success.

How to Become a Funded Trader

Becoming a funded trader with a prop firm requires passing a challenging evaluation that tests your ability to navigate the financial markets. Once you pass, you will receive access to the firm's capital to trade freely and without interference. While anyone can become a funded trader, it is no easy feat. This is because, before giving you access to its funds, the prop firm needs to be sure you possess the ability and skill set to be a profitable trader. To prove this, you are required to pass the funded trading challenge set by each firm and according to its own set of rules and standards.

The evaluation process usually involves a two-step challenge, where you must first generate a 10% profit on your account in 30 days, and then make an 8% return on your investment in 60 days. Your maximum daily loss is typically limited to 5%, and the maximum loss for the entire evaluation period is around 12%. You only properly and officially become a funded or prop trader once you successfully pass the challenge.

The catch with prop firm challenges is that they are intentionally designed to be difficult and test your trading psychology. Each firm has its specific set of trading rules, but the two main ones that often lead to disqualification are exceeding the daily drawdown limit and the maximum drawdown limit. You are also restricted in terms of the instruments you can trade, news trading, holding trades over the weekend, and other trading rules.

Since as already discussed almost all prop firms are not regulated, it is thus crucial to choose a reputable firm with fair evaluation terms. Additionally, passing the evaluation is not the end of the journey. Keeping the account and remaining profitable is just as challenging as the evaluation itself. Even with a large account to trade with, the maximum drawdown limit will always be in place, and you must exercise discipline and self-control to remain profitable.

When choosing a forex prop trading firm, several factors should be considered to make an informed decision. By taking these factors into account, you can choose the right prop firm and increase your chances of success as a funded trader, but first, you must know what your own goals are.

Defining Your Goals

Defining your goals is a crucial step before choosing a prop trading firm. Do you value quality service above all else? Or are you more concerned with finding a firm that offers low fees and tight spreads? By taking the time to determine your priorities, you'll be better equipped to find the right firm to meet your needs. To meet with success as a funded trader, you need to find the prop firm that best suits and fits your own needs, trading styles, goals, and expectations. Once those are well defined in your head, then you are ready to start comparing and contrasting prop firms, to determine which is the best for you.

The Best Prop Trading Firms in 2026

Rating breakdown

Things we liked:

Unlimited time for completionReal Funding and Daily Payouts

Things we didn't like:

High challenge difficultyRating breakdown

Things we liked:

Unlimited time for completionReal Funding and Daily Payouts

Things we didn't like:

Futures onlyNo free retry

Rating breakdown

Things we liked:

Up to 100% Profit SplitUnlimited Number of Trading Days

Fast Payouts

Things we didn't like:

10% Max Loss Limit on Accounts$10 Withdrawal Processing Fee

No swap free accounts

What to look for when choosing the right prop firm?

When evaluating prop firms, it's important to consider several factors. For example, take a close look at the trading restrictions imposed by each firm. While some restrictions may be reasonable, others could severely limit your earning potential. It's essential to choose a firm with restrictions that align with your unique trading strategy.

Another important factor to consider is the product range and type of instruments offered by each firm. Some firms specialize in stock market trading, while others offer futures and options trading. The range of products and instruments can vary greatly, so it's crucial to do your research and choose a firm that offers the specific products and instruments you're interested in.

In a nutshell, choosing the best prop trading firm requires careful consideration of several factors. By comparing profit splits, funding options, tradable assets, evaluation processes, duration, and promotion criteria, you can select the prop firm that best suits your trading style and goals. Ultimately, the key to choosing the right prop trading firm is to be as specific as possible about your goals and needs. With careful research and consideration, you can find a firm that offers the services and products that align with your unique trading strategy, helping you achieve success in the markets in 2023 and beyond.

Regulation and Safety for Traders

In the financial markets, regulators act as the first line of defense against fraud. Their primary responsibility is to protect investors and prevent any abuse. Therefore, it is crucial for prop firms to establish a solid relationship with regulators and adhere to all relevant laws and regulations.

The most common regulatory frameworks for prop firms are the FCA (Financial Conduct Authority) in the United Kingdom and CySEC, the local Cypriot watchdog, in the European Union. However, other regulatory bodies such as ASIC (Australian Securities Investment Commission) and CFTC (Commodity Futures Trading Commission) also exist.

It is essential to note that regulatory bodies have distinct requirements for each country. As such, choosing a broker that complies with the relevant laws in your country is critical.

Determining the Legitimacy of a Prop Firm

While as already discussed, prop firms are not scams by nature, scammers may still pose as prop firms. This can be especially tempting for beginner traders who are often attracted to prop firms. Therefore, it is crucial to distinguish between good and bad prop firms. Here are the key factors to consider:

- Prop Firm Reputation – Choosing a reputable prop firm is crucial. Evaluating a prop firm's reputation can help you make an informed decision. For instance, checking their rating on different platforms like YouTube can help you understand their performance and pros and cons. You can also visit forums where people share their experiences with different prop firms. However, it's essential to filter out trolls, who may defame the firm deliberately.

- Support – A reputable prop firm should have an excellent support system in place. Knowing that you can rely on their support at any time can provide a sense of relief. Therefore, it's essential to confirm that their support is available round the clock and it is easy to get through to and quick in its responses.

In summary, adhering to relevant laws and regulations is essential for prop firms. While not all prop firms are scams, it's crucial to distinguish between reputable and fraudulent firms. Checking their reputation on various platforms and evaluating their support system can help you determine their legitimacy.

How to Identify a Shady Prop Firm

Proprietary trading firms can offer an excellent opportunity for traders to grow their skills and potentially earn profits, but not all firms are created equal. Some prop firms may not have the best intentions, so it's important to know what to look for when assessing a potential prop firm. When trying to determine if a prop firm is shady and should not be trusted, watch out for the following warning signs:

- Lack of Trustpilot Presence – Most reputable prop trading firms will have reviews on sites like Trustpilot. Make sure that any Trustpilot link provided is genuine and clickable, and check recent reviews to see what other traders are saying. Every firm will have some negative reviews, but if the majority of reviews are negative, it's a definite red flag.

- Poor Website Quality – A well-established and legitimate prop trading firm should have a professional and well-designed website. If the site is full of spelling mistakes or looks poorly presented, the chances are that behind it is not a reputable firm.

- Minimal Online Presence – A reliable prop trading firm should have a strong online presence, including social media accounts and an email list. If a firm lacks these and you cannot find it on Facebook, Instagram, YouTube, etc., then this may well be a sign that they are not as reputable as they would like you to think they are.

- Unresponsive Customer Service – If a prop firm has a history of unresponsive customer service, this is a major warning sign. A reliable firm should be responsive to its clients and provide timely support when needed.

- Sounding Too Good to Be True – Prop firms are known for offering challenging trading opportunities, so if you come across one that seems too easy, this is a warning sign. If a prop firm claims to offer much higher profit targets, much lower drawdown rules, or lower costs for direct funding, it may be a sign that they are not a reputable firm.

Therefore, before you decide to work with a prop trading firm, make sure you do your due diligence and research the company thoroughly. By looking out for these warning signs, you can avoid falling prey to a bad actor in the prop trading industry.

Other Factors to Consider when Evaluating and Selecting a Prop Firm

Once you make sure you avoid shady prop firms, you still need to rigorously evaluate reputable prop firms to identify the most suitable and best for you. When selecting a prop trading firm, it is crucial to consider its growth program to ensure that it can provide opportunities for you to develop and increase your trading account. It's worth noting that many firms do not immediately give new traders a large account and require them to prove themselves first. To avoid limiting your potential earnings, look for a prop firm with a solid growth plan. It's in the best interest of both parties to have a growth plan, as it can lead to increased profits.

Additionally, make sure that the firm's target goals align with yours to avoid compatibility issues. Keep in mind that there may be participation costs associated with trading with a prop firm, so be sure to carefully consider the restrictions, costs, and payment models that work best for your financial situation. During your research, you may come across prop firms with a one-time fee, subscription model, proprietary trading fee, or no payment required at all. Choose the payment model that works best for you and the prop firm that will help you grow as a trader.

Moreover, another key factor to consider when making your choice is the payout options that the prop firm offers. It's important to review the terms and conditions to know how often you can make withdrawals and whether this will affect your growth. Many prop firms split profits with their traders, typically starting at 50/50 and potentially increasing to 65/35 as the trader proves their skill. It's crucial to ensure that you are comfortable with the payout structure, as taking home profit is a key motivator for traders. Another factor to consider is the resources offered by the prop firm.

Some firms offer more than just a funded account, including access to advanced dashboards, live trading rooms, and educational materials. It's important to assess the quality and ease of use of these resources to ensure they are helpful to your trading. Customer support is also an essential factor to consider when choosing a prop trading firm. A broker that provides excellent customer support through live chat or phone can be a valuable resource for traders seeking information and guidance. Knowing your options and finding a firm that aligns with your needs can help you succeed in the world of prop trading.

Can I be a successful proprietary trader through manual trading?

Is it possible to earn money with prop firms?

One of the biggest questions on the minds of aspiring traders looking to join a prop firm is whether or not they can actually make money trading with them. While the answer is not a simple yes or no, in theory, it is possible to make money with a prop firm. However, the reality is that the vast majority of traders who attempt to join prop firms will not succeed. This is because prop firms only fund the top-performing traders, meaning that less than 5% of those who attempt to pass the evaluation test will go on to receive a profit split. Opponents of prop firms use this as evidence that the entire business model is a scam, while supporters argue that this success rate is comparable to that of traders who use their own funds.

For successful traders with profitable trading strategies, it may not make sense to join a prop firm, as trading on their own account may be more profitable in the long run. However, some traders may choose to join a prop firm due to a lack of initial capital, as prop firms can offer the necessary funding for traders to get started.

It's important to note that prop firms often have strict requirements and limitations, such as limiting the amount of risk a trader can take without losing their account and setting a profit target and time limit. As a result, short-term trading strategies tend to be favored over long-term ones, which may not be suitable for all traders. Before considering joining a prop firm, traders should carefully consider the requirements and limitations to ensure their strategy aligns with the firm's parameters. Prop trading is not for all; however, it may be a great opportunity for traders who already have a working trading strategy that is able and proven to yield positive results consistently.

The Safe Way To Use Prop Firms

Maximizing your chances of success and minimizing risk is the ultimate goal for any trader looking to work with prop firms. To achieve this, it is recommended to employ a strategy that involves trading with multiple legitimate prop firms, while also trading on your main account with your own capital.

In fact, diversifying your risk among multiple firms is a smart move that can help protect you against the risk of losing everything in case one of the firms goes out of business. By spreading your risk among multiple firms, you increase your chances of success and reduce your overall risk.

In addition to trading with multiple firms, it would also be advisable to compound your profits and invest them in your main account rather than leaving them in your funded accounts. Using software like MT4 Copier can help you copy all your trades across your accounts, making it easier to manage multiple funded accounts.

While joining as many prop firms as you can manage is a good strategy, it's important to do so sanely and keep track of all the different requirements and limitations. Finally, it's essential to rinse and repeat this process to continue growing your account and maximizing your potential for success.

How to Profit from Prop Trading Firms

Maximizing profits and minimizing risks is essential when trading with prop trading firms. One of the most critical things to keep in mind is that you don't have to trade exclusively with one firm. Experienced prop traders suggest joining as many trustworthy firms as possible, preventing you from losing all your money if one firm turns out to be less than you expected it to be.

Furthermore, successful prop traders recommend having a personal trading account, funded with your own capital, in addition to accounts with at least two prop firms. That way, you can use your personal trading account as your main account and grow your capital simultaneously. To make the most of trading with prop firms, use the following strategy:

- Trade with at least two trustworthy prop firms simultaneously.

- Use your personal trading account as your main account.

- Withdraw profits monthly from your prop firm accounts to avoid losing all your funds if a firm runs into trouble.

- Add the withdrawn funds to your personal account to increase your capital.

Remember that trading with prop firms requires you to be a successful trader, and you can ultimately grow your capital to the point where you no longer need prop firms and can trade entirely on your own.

Final Thoughts

Concluding your search for the best prop forex firm is not an easy feat, as it requires thorough research and evaluation of several factors. It is essential to consider factors such as the platform's analytical tools, the firm's reputation, and your personal trading goals to make an informed decision. Reviews and testimonials from other traders can also be valuable resources in your search for the best prop firm. Ultimately, the key is to find the right fit that meets your individual needs as a trader. With careful consideration and diligence, you can find a prop firm that aligns with your goals, personality, and risk tolerance and helps you achieve success in the dynamic and exciting world of forex trading.

FAQs on Proprietary trading

The simple answer to the question is No. When it comes to the legitimacy of prop firms, one should be aware that while the basic business model of prop firms is not inherently fraudulent, unfortunately some prop firms do engage in shady practices or outright scams. However, if you join a prop trading firm after having done the proper due diligence and research and proceed to trade on a solid strategy, you might be in for some huge benefits. In a nutshell, with the right approach and mindset, prop trading may well be a fully legitimate and highly profitable way to trade the markets.

Merger arbitrage, index arbitrage, global macro-trading, and volatility arbitrage are among the most popular strategies used by prop traders to maximize returns. When it comes to strategies used by prop firms, there is no one-size-fits-all approach. Different firms use different strategies, just like each trader has their own unique style. However, there are some common strategies used in prop trading utilized in order to achieve the maximum possible returns. One such strategy is merger arbitrage, where traders seek to profit from the price discrepancies that arise during a merger or acquisition. Another popular strategy is index arbitrage, which involves exploiting price differences between a stock index futures contract and the underlying components of the index. Global macro-trading is another popular strategy, where traders analyze global events and economic trends to identify opportunities to profit from market movements. Finally, volatility arbitrage involves profiting from discrepancies between the implied volatility of an asset and its actual volatility. Moreover, to enable them to make informed trading decisions, proprietary traders have access to sophisticated software and pools of information. This helps them to identify patterns and trends in the market, and make more informed trades. By using a combination of these strategies, proprietary traders are able to maximize their returns and achieve success in the highly competitive world of trading.

One of the main advantages of working with a prop firm is the potential for higher earnings. Traders can access more capital to trade with, allowing them to potentially make more profits. Additionally, working with a prop firm means being surrounded by experienced traders and mentors, which can be a valuable source of knowledge and skill development. On the other hand, there are some cons to consider when working with a prop firm. The high level of competition can be a challenging aspect to navigate, as traders are often competing against each other for the same opportunities. Additionally, many prop firms charge high fees for their services, which can eat into a trader's profits.

It may come as a surprise to many, but statistics show that only a mere 4% of forex traders manage to successfully pass the rigorous forex prop firm challenges. And out of that 4%, only 1% of traders are able to maintain their funded accounts over the long term without violating any rules. While these figures may seem discouraging, it is important to note that they are intentionally designed to be this way. Prop firms are looking for traders who can consistently make profitable trades with minimal risk, which is why they have set the bar so high.

According to various studies, a large percentage of day traders, ranging from 95% to 99%, tend to lose money instead of earning a profit. These findings are supported by research that shows that very few traders are successful in making significant amounts of money through day trading. However, it is worth noting that proprietary traders, who work for prop firms and have access to more capital and resources than retail traders, tend to fare better in terms of profitability, though their success rate is still relatively low.

Yes, it can be highly beneficial to trade with a prop firm, for as long as you are a skilled trader who can meet the prop firm’s evaluation criteria. If you are able to pass the evaluation and become a funded trader, you will have access to the firm's capital and potentially be able to trade with more substantial amounts over time, thus paving your way towards lucrative profits.

When evaluating prop firms, it's essential to consider several factors such as profit splits, available funding, tradable assets, evaluation process, duration, and promotion criteria. Comparing and contrasting all of these elements before deciding which firm to partner with, is of paramount importance if you don’t want to make the wrong decision and it is the only way to help you select the prop firm which best suits your trading style and personal goals as a trader.

While most prop trading firms are not subject to regulatory oversight, there are some exceptions. In the United States, proprietary trading firms that are registered as broker-dealers with the Securities and Exchange Commission (SEC) may be required to join the Financial Industry Regulatory Authority (FINRA) under proposed rule amendments from the SEC in July 2022. However, even if a firm is not regulated, it's still important to thoroughly research and vet any firm you're considering trading with.