⚔️ The Great Filter vs. The Great Betrayal: Analyzing the Prop Firm Reckoning

Executive Summary

| Focus | Core Conflict | Key Data Points | Trader Takeaway |

|---|---|---|---|

| Prop Firm Rules Change, Trader Payout Denial, Prop Firm Liquidity Crisis | The erosion of trust due to retroactive rule changes and payout blackouts disguised as compliance checks. | 13–14% of firms failed; only 5–10% of traders pass evaluation; ~7% of starters get paid. | Verify Payout Proof over challenge marketing. Focus on Compliance over Profitability. |

Read our earlier breakdown of prop firm rule changes for additional context.

1. The Core Conflict: Profitable Traders as Pariahs

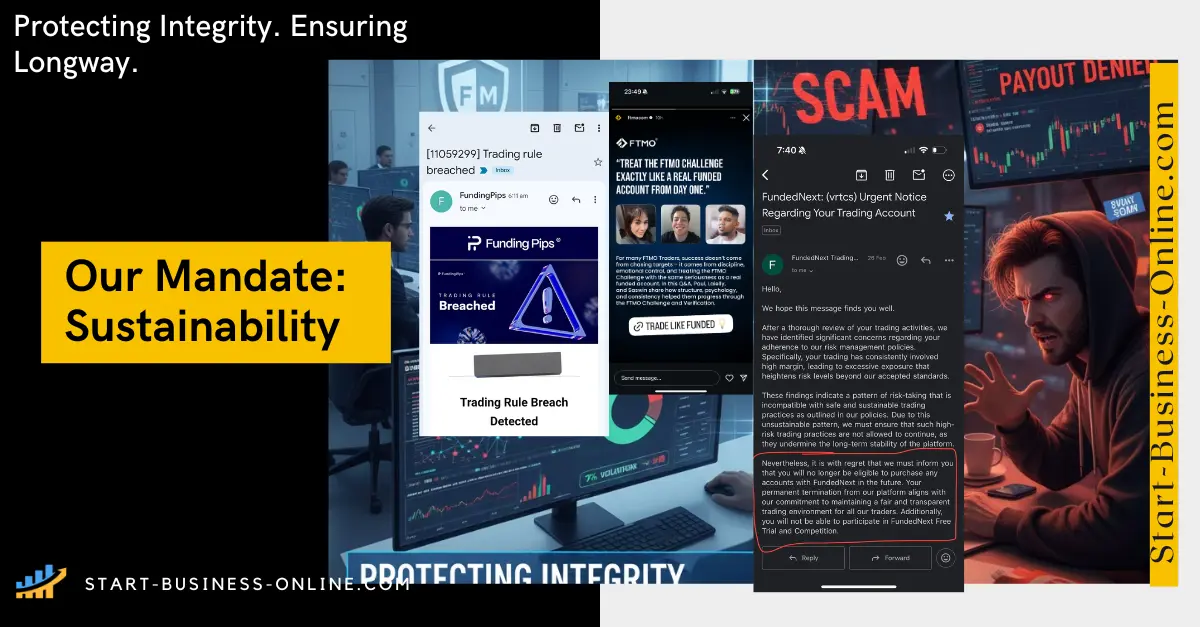

The central tension dominating social media platforms like X.com is the perverse paradox of profiting too much. Firms, which sell the promise of funded capital, are being exposed for allegedly terminating top performers under the guise of "policy re-evaluation."

| Trader’s Claim (X.com Allegations) | Firm’s Technical Defense | The Real Rationale for Termination |

|---|---|---|

| “I was closed after hitting my target for a rule that was unwritten.” | The Integrity Defense: Violation of broad Forbidden Trading Practices (e.g., latency arbitrage, exploitative tick scalping, server abuse) that exploit demo/server limitations. | Termination protects the data/risk models so payouts are based on reproducible skill, not technical arbitrage—safeguarding the capital pool. |

| “They just don’t want to pay profitable traders.” | The Fiduciary Defense: Profits generated via a material breach (e.g., latency arbitrage or coordinated hedging across multiple accounts) are contractually illegitimate. | Zero-tolerance on exploitative behavior preserves long-term stability and the firm’s ability to pay compliant traders on time. |

| “My risk was acceptable; I know what I’m doing.” | The Risk Management Defense: Activity reflects an unrealistic risk profile (e.g., martingale, lot spikes, excessive leverage). Most pro desks cap single-trade risk at ~1–2% of capital. | The firm is filtering for disciplined risk managers, not gamblers; failure to achieve consistency curves signals inadequate risk discipline for institutional mandates. |

The "Cardinal Sin" of Winning

Reports indicate a specific firm, a former market darling, has recently come under fire for abruptly shuttering accounts of highly successful traders. This action, often attributed to generic "policy re-evaluation," is seen by the community as a desperate attempt at revenue protection, not risk management. The logic is simple and absurd: the firm funds traders to win, then penalizes them for winning too well or too consistently.

The Accusation: Firms rewrite rules post-success to retroactively penalize profitable traders, effectively capturing the challenge fees while nullifying the payout obligation.

The Community Response: Watchdogs and veteran traders are linking these new tactics to previous industry scandals involving similar bait-and-switch maneuvers, demanding immediate and actionable transparency regarding policy changes.

For a practical framework on how to vet programs, see How to Choose a Prop Firm.

2. Systemic Sabotage: From Liquidity Crunch to Discrimination

Liquidity Blackouts and Cash-Flow Camouflage

Veteran traders, including those with substantial, verified payouts (e.g., over $300K in historical withdrawals from major platforms), are sounding the alarm about a looming liquidity crunch.

Stalling Tactics: Firms are increasingly resorting to "extra verification" or sudden Know Your Customer (KYC) "reviews" weeks after a challenge is passed or a payout is requested. These are viewed not as genuine compliance efforts but as cash-flow camouflage—stalling tactics used when funds are low.

The Pattern of Predation: This pattern escalates from weeks-long payout freezes to outright denials, prompting calls to investigate firms showing clear insolvency red flags (e.g., mysterious foreign registrations).

The Geographical Discrimination Problem

A severe, yet often under-discussed, battle involves geographical blacklisting. Social media threads have exposed how a significant percentage of firms (allegedly over 50%) either blacklist or aggressively throttle payouts to traders from certain regions, notably African countries.

This is viewed as outright discrimination, where the financial risk of a region is unfairly extrapolated to deny payouts to highly skilled, compliant individuals.

⚙️ The Tech-Fueled Treachery

The rules themselves are increasingly becoming the enemy, often designed to maximize the likelihood of account breaches even on successful trades.

Trailing Drawdowns: These mechanics, which can breach an account even if a trade hits its Take Profit (TP) target if the drawdown was hit en route, are branded as insidious and are a source of mass frustration.

Consistency Rules: These rules are often criticized for forcing traders into sub-optimal decision-making, warping genuine strategy to fit arbitrary daily/weekly volume or size requirements.

If you’re choosing between models (1-step, 2-step, instant), our guide to value picks may help: Cheapest Prop Firm Challenges.

3. Traders' Counteroffensive: Exposés, Boycotts, and Reform

The Power of Collective Action

Traders are abandoning isolation and embracing collective action:

Unified Boycotts: Calls for unified boycotts are gaining traction, specifically targeting firms that employ excessive "interview" hurdles, consistency traps, or retroactive rule changes. The strategy is clear: "Don't buy their challenge" until ethical standards change.

Advocacy and Audits: Independent trader advocates are publicly vowing to "call out" and "review" controversial outfits, demanding verified proof-of-payouts and exposing affiliate marketers who peddle biased "unbiased" reviews while profiting from commissions.

The Glimmer of Hope

Amid the chaos, signs of innovation and progress suggest the industry can be reformed:

Transparency Tools: New platform launches are integrating tools that verify challenge rules and payout processes, injecting much-needed transparency into the system.

Democratization: Rumors of major industry players axing challenge fees suggest a potential shift toward democratizing access and focusing on performance metrics rather than initial revenue generation.

New to evaluations? See our primer with pass-focused tactics: Beginner-Friendly Prop Firm Challenges.

4. Conclusion: A Redefined Skillset for Survival

The ultimate takeaway for the modern trader is that the battle is not just against the market, but against the firm's own survival mechanism. The industry is transforming from a casino to a highly unforgiving coliseum.

Skill Redefined: Success is no longer measured by gross profit, but by compliant, verifiable, and boringly consistent risk management within the firm’s rigid parameters.

Vigilance is Alpha: The future belongs to the vigilant. Traders must ruthlessly vet firms, demand proof-of-payouts, and recognize that what firms sell as "risk management" often acts as "revenue protection." The real foe is often a lack of discipline, but the immediate threat is an industry prioritizing survival over the trader-firm symbiosis.