Prop firms are the buzzword in trading circles these days and for good reason – some prop firms are offering to fund traders with up to $5 million in company capital. Profits from funded accounts are shared between firm and trader – usually an 80/20 split – but with some firms allocating 90% of any profits earned to the trader. Millions in company capital, majority of profits, zero responsibility for any losses, regular payouts, and access to powerful trading software – what’s not to like? As more traders join the ranks of funded clients and scale up their accounts to the maximum, new prop firms are entering the market.

Page Contents

- 1. Proprietary Trading Firm - Everything You Need To Know About

- 2. What are the expenses associated with funded trading?

- 3. Is there a simpler way to obtain funding?

- 4. Why are prop trading firm evaluations less advantageous?

- 5. Which are the most affordable prop firms?

- 6. Ready for a Challenge?

- 7. Leverage your talent

- 8. Have you considered a Free Trading Program?

- 9. Conclusion – can you get funded for free?

- 10. FAQs on Most Affordable Prop Firms

View more

A few years ago, a select few prop firms dominated the space. Today, traders can choose between a wide array of proprietary trading firms, each with its unique characteristics, trading rules, profit distribution schemes, and associated costs. Traders may be asking themselves the “million(s)” dollar question: Which is the cheapest prop firm?

For many traders, the price of entry is the first hurdle to cross—but affordability shouldn't come at the cost of risk. If you're looking for firms that offer budget-friendly evaluations with conservative rules, our guide to Top Prop Firm Challenges for Low-Risk Traders breaks down the best options for consistency-driven traders.

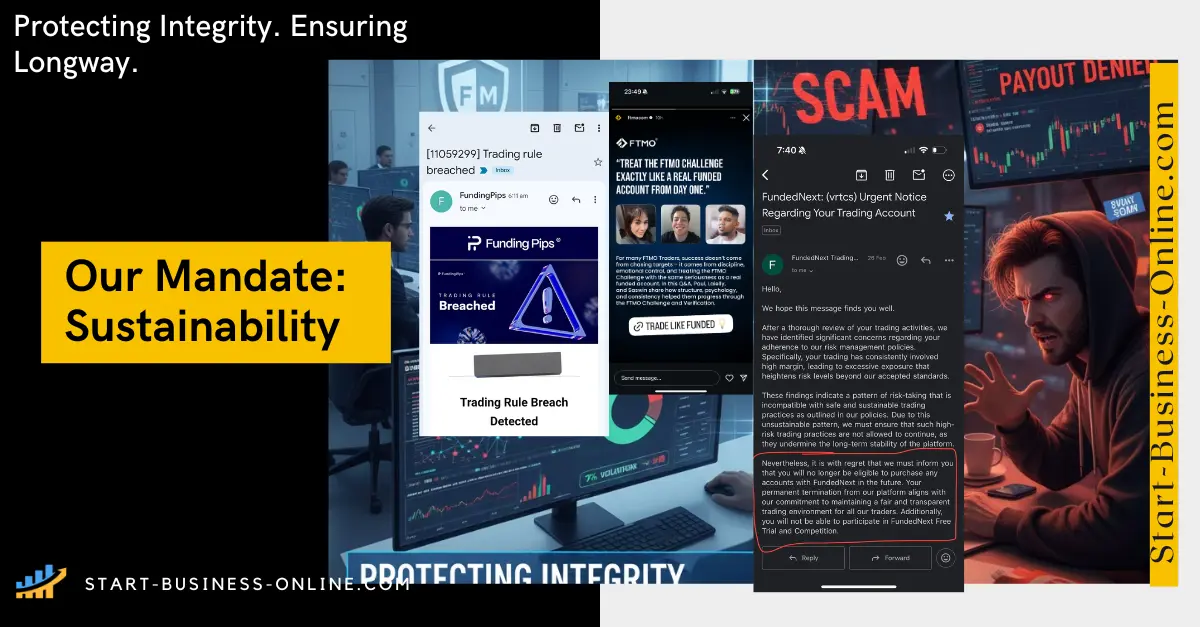

Having said that, as the prop firm industry expands rapidly, finding the most cost-effective prop firm isn’t easy. Moreover, traders should tread carefully as not all prop trading firms can be considered reliable. Certain firms may subject traders to ongoing challenges with the sole intention of retaining their access fees, rather than focusing on evaluating their trading strategies and mutually benefiting from the profits.

Before we discuss the “cheapest” or most cost-effective prop firm, let us run through a quick overview of the main expenses facing funded traders.

Proprietary Trading Firm - Everything You Need To Know About

What are the expenses associated with funded trading?

- Monthly fee for real-time data

- Access fee for trading platform

- Additional costs like subscription fees or commissions (depending on the provider)

- Traders can keep a portion of the profits (up to 90%)

- Ability to request payouts to current accounts

There is no such thing as a free lunch, right? While the funded trading avenue is a popular choice for traders seeking fast-track accounts, there are costs involved outside of the initial sign-up fee. Funded traders are typically charged a nominal monthly fee to access the trading platform and real-time data. There may be additional costs such as subscription fees and commissions.

Traders need to demonstrate their ability to hit regular profit targets without excessive losses before trading company capital. Prop firms will use a one-off or series of internal evaluations or “Challenges” to monitor traders, usually with demo accounts. Those who pass the test will be given funded accounts and can trade with real money. Following funding, traders can retain up to 90% of their profits and request payouts to their accounts. Notable funded trading programs, like TopStep, charge $495 for three-month memberships or $990 for six-month memberships, and similar cost structures can be found across firms.

Is there a simpler way to obtain funding?

Many traders will understandably be impatient to get started with live accounts. The evaluation phase can be a helpful training program for a first-timer. However, a more experienced trader with a successful strategy but who is lacking both funds and time may wish to have an alternative avenue to funding – a “fast-track” option as it were. Luckily for anyone who falls into the second category, many prop firms have just this feature. The fast-track funding, sometimes referred to as an “Accelerated Program” or “Instant Funding” allows traders to bypass the evaluation stage and immediately open a funded – with real money – account. Traders will have to pay for this luxury, and the extra fee will vary from prop firm to prop firm, but the advantage is two-fold: traders are both guaranteed funds and they can begin right away with a live account.

Why are prop trading firm evaluations less advantageous?

Let’s face it: funded trading does not come without its costs. Joining a prop firm typically entails a one-time fee, covering either the evaluation or the direct funding. Traders have to make a choice: they can take the evaluation-based approach or skip ahead to direct funding. There is a lot weighing on this decision: traders who pass the evaluation will have the one-time fee refunded into their account – however, it is worth noting that not all individuals succeed in the evaluation process. Some prop firms deliberately set stringent evaluation criteria as their revenue stems from traders failing evaluations. Bear in mind that firms that claim to offer refunds will be referring only to those traders who proceed to the verification stage of funding.

Which are the most affordable prop firms?

This is the golden question among novice prop traders! Typically, many prop trading firms charge a monthly subscription fee ranging from $150 to $25,000. As you can imagine with such a range, prop firms differ widely in their features and associated benefits or drawbacks, and traders will need to compare the offers and decide accordingly. We understand the complexity of the decision-making process, and to help in finding the most suitable platform, we have compiled a comparison table featuring reliable and reputable firms preferred by traders worldwide. The table highlights their key features and pricing plans, with a focus on the access fee for an average funded account of $50,000. We will also provide a separate comparison between prop trading firms with one-time payment options for accessing the evaluation and those with recurring monthly payments.

The Best Prop Trading Firms in 2026

Rating breakdown

Things we liked:

Unlimited time for completionReal Funding and Daily Payouts

Things we didn't like:

High challenge difficultyRating breakdown

Things we liked:

Unlimited time for completionReal Funding and Daily Payouts

Things we didn't like:

Futures onlyNo free retry

Rating breakdown

Things we liked:

Up to 100% Profit SplitUnlimited Number of Trading Days

Fast Payouts

Things we didn't like:

10% Max Loss Limit on Accounts$10 Withdrawal Processing Fee

No swap free accounts

| Prop Firm | How much they charge - Challenge Fees |

|---|---|

| FunderPro | FunderPro offers four tiers of funded account challenges: a $25K balance costs $250, a $50K balance costs $300, a $100K balance costs $550, and a $200K balance costs $995. Scaling plan up to $5 million. |

| FunderPro Futures | Challenge fees: $79–$299 (no hidden costs) |

| Funding Pips | Fees range from $100 to $500. $100 for a 5K account; $200 for a 10K account; $300 for a 25K account; $400 for a 50K account; $500 for a 100K account. |

| FXIFY | Assessment fees range between $175 and $1,999 depending on the capital access you need, with pricing increasing as funding does. |

| FundedNext | For FundedNext evaluation model, you pay for the challenge costs from $99 for a $15,000 funded account to $999 for a $200,000 funded account. |

| FTMO | The FTMO Challenge with an initial capital EUR 10k balance costs €155; 25k balance for €250; 50k balance for €345; 100k balance for €540; 200k balance for €1080; Scaling plan up to $2 million. |

| Apex Trader Funding | |

| Bullwaves Prime | |

| the5ers | The 5%ers Challenge an initial $6,000 balance costs €235; $10,000 balance for €385; $20,000 balance for €745 and a Scaling plan up to $4,000,000. |

| SabioTrade | SabioTrade offers four account tiers: $10K, $50K, $100K, and $200K. The prices are $50, $289, $479, and $939, respectively. |

| Top One Futures | |

| Take Profit Trader | Monthly Test fee: $150–$360 (PRO reset one‑off fee) |

| NeomAAA Funds | Instant $99–$1 839 • 1‑Step $55–$596 • 2‑Step $52–$485 |

| ThinkCapital | Lightning $59–$949 • Dual‑Step $59–$949 • Nexus $59–$949 |

| Hola Prime | Fees TBA (launch 2025) |

| UltraCap Trading | |

| MyFundedFX | |

| TX3 Funding (Toptier Trader Rebrand) | Prices for the challenges at Top Tier Trader begin at $250 for a $25k account and top out at $1399 for the $300k challenge. a $25K balance costs $255, a $50K balance costs $50, a $100K balance costs $560, $200K balance costs $999 and a $300K balance for $1399. |

| BlueBerry Funded | |

| Topstep | The TopStep Challenge with an initial balance $50K costs $165; $100K balance for $325; $150K balance for $375 (per month) |

Looking at the table above, you can see that the “cheapest” is not necessarily the best. Nor will it remain the “cheapest” for long. The money you will save on the initial sign-up fee will quickly be dwarfed by associated costs down the line. Check the chart: we can easily see the cheapest prop firm according to the challenge price: it is free! However, upon further examination, you will see that this firm also has the longest challenge with the most steps – vastly reducing the likelihood of securing any real funding in the long term. Simply put, you need to compare all the options and choose the one that best suits you as an individual: find a program that aligns with your trading style, risk appetite, and available time.

We also recommend that you compare the best prop firms that offer direct funding (instead of the evaluation process). This may be worth considering if you are confident in your trading strategy and keen to get funded right away. On our website, we have a comparison chart of the top prop firms with instant funding. The associated fees will be higher, but in return, you can begin trading with a funded account immediately. Finally If you're the kind of trader who thrives on big targets, tight timelines, and aggressive scaling, explore our Higher-Risk, Higher-Reward Prop Firm Challenges to find funding programs that match your high-conviction trading style. Money-saving tip: check out our prop firm discounts section for discount coupons, promo codes, and other offers. We have done the research and collected the discounts to ensure that you not only choose the top prop firm for your needs, but you are guaranteed the best available prices!

We’ve also published an update focused specifically on $100K evaluations. View our full comparison of the cheapest prop firm accounts by $100K challenge price to see who's currently leading on affordability.

Best Prop firms offering affordable $100000 Accounts (focus not just on price).

| Prop Firm | Challenge | Fee | Discounted Price ▲ | Profit Split | Max DD |

|---|---|---|---|---|---|

| FunderPro (4.8/5.0) | 2-Phase Regular 100K |

|

| 80% | 5% |

| the5ers (3.8/5.0) | $100,000 - High Stakes |

|

| 80% | 5% |

| FXIFY (4.1/5.0) | FXIFY - Two Phase 100K |

|

| 90% | 4% |

| Funding Pips (4.2/5.0) | Funding Pips 2-Step 100K |

|

| 80% | 0% |

| FTMO (3.9/5.0) | $100,000 - Aggressive |

|

| 90% | 10% |

Cheapest $100000 Accounts (focus ONLY on price).

| Prop Firm | Challenge | Fee ▲ | Discounted Price | Profit Split | Max DD |

|---|---|---|---|---|---|

| Alpha Trader | 100,000 2-Step |

|

| 90% | 4% |

| Tycoon Funded | 100,000 2 Step Challenge |

|

| 90% | 4% |

| TradingFunds | 100,000 2-Step Challenge |

|

| 80% | 4% |

| BlueBerry Funded | $100,000 | 2 Step Evaluation |

|

| 80% | 5% |

| Funding Pips | Funding Pips 2-Step Pro 100K |

|

| 80% | 0% |

| Propel Capital | 100K Reversal Plan |

|

| 80% | 4% |

| Propel Capital | Propel Pro 100K |

|

| 80% | 4% |

| Plutus Trade Base | 2 Step Challenge 100K |

|

| 95% | 7% |

| Lux Trading Firm | $100,000 - Standard |

|

| 75% | 5% |

| Tradexprop | X 2-Step 100K |

|

| 80% | 5% |

| NeomAAA Funds | Two‑Step Challenge 100K |

|

| 80% | 4% |

| For Traders | Two-Step PRO 100k |

|

| 90% | 0% |

| Clarity Traders | 100,000 Traditional Challenge |

|

| 100% | 4% |

| the5ers | $100,000 - High Stakes |

|

| 80% | 5% |

| Blue Guardian | $100,000 | Unlimited Evaluation |

|

| 85% | 4% |

| EverBlue Trader | $100,000 2-Step Evaluation |

|

| 80% | 5% |

| Bold Fund | 100,000 2 Step Challenge |

|

| 80% | 5% |

| FTUK | $100,000 | 2 Step Challenge |

|

| 80% | 5% |

| ThinkCapital | Dual‑Step 100K |

|

| 80% | 4% |

| City Traders Imperium | $100,000 - Standard Challenge |

|

| 80% | 4% |

Ready for a Challenge?

Prop Firm Competitions- Methods to Get a (Completely) Free Prop Firm Challenge!

One popular way prop firms like to find the best traders and attract new talent is by running trading competitions similar to Forex Demo Trading Competitions we have covered extensively in one of our previous guides. If you decide to go down the avenue of a free prop firm challenge, make sure you understand what you are signing up for. Most prop firms will have strict rules, including:

- Drawdown limits: Be aware of daily and overall drawdown limits, understanding how they are calculated (relative or absolute).

- Algo trading rules: If you use Expert Advisors or engage in copy trading, review the rules regarding algorithmic trading methods.

- Winning criteria: Not all firms solely prioritize raw profit. Some value consistency or other factors. Check how traders are ranked and what criteria determine the winners.

- Additional rules: There can be various additional rules, such as weekend holding restrictions, lot size limitations, consistency requirements, and more. Make sure you thoroughly understand all the rules before participating.

Don’t jump into any prop firm challenge without carefully reading all the rules and requirements.

Now let’s look at which prop firms offer trading competitions.

Leverage your talent

Traders frustrated by limited funds may feel that prop firms are their only option. The reality is that with a little “out of the box” thinking, you could find yourself earning money through trading in unlikely ways. Don’t let a lack of capital hold you back from leveraging your talent! Here are some ideas to get you started:

- Signal Services: Ever thought about providing signals or letting others copy your trades? Look into services like the Metatrader signal service for exciting opportunities.

- Trade Journal Sharing: If you've been smart enough to keep a record of your trades, why not reach out to different prop firms and see if they can lend a helping hand?

- Go Offline: Look for proprietary trading jobs in your local area. If you're close to a bustling city, chances are there's a live trading room out there on the lookout for talented and profitable traders like yourself.

Have you considered a Free Trading Program?

Is there another way? As the prop firm industry continues to expand, traders are faced with ever more avenues to funding. One alternative to the traditional prop firm route is by joining a trading program. Many traders are looking for the “best free funded account.” No wonder then that "free funded trading," "free prop trading account," and "the best free funded trading account" are three of the most searched terms by traders on Google. You probably asked yourself this very question and that is what brought you to this page! The hard truth is, however, that most prop firms will not simply give you a free trading account.

Most online prop trading firms do not support free funded trading accounts, and it is important to understand their business model. Prop firms typically operate by generating revenue from failed Challenge or Evaluation fees, while funding a small number of successful traders. Some other Firms focus is on developing exceptional traders and sharing in their profits. While they do rely on some income from the evaluation fees, according to their statements their overall profitability stems from the success of their traders. As a result, they are willing to offer a limited number of free-funded trading accounts.

Since we announced our intention to launch a market-leading funded trading program, the demand for a free prop trading account has been overwhelming. You wouldn’t believe the number of requests we have received from traders claiming to be highly successful, often with alleged “proof” of their lucrative track record. However, we have found that many of these claims turn out to be false, with some traders even providing fabricated or copied data obtained from elsewhere. While we have strong relationships with our brokers and conduct research to verify claims, this is both a time-consuming process and not the ideal use of our resources.

The challenge lies in identifying the small number of exceptional traders who genuinely seek a free-funded trading account. Naturally, they cannot offer free funded trading accounts to all traders, as it wouldn’t be sustainable for any business model to give away its product entirely. Herein lies their dilemma: they either invest substantial time, money, and resources in filtering and selecting a few exceptional traders or they opt for a different approach.

While their competitors have gone down the conventional route, those firms are forging a new path: they will invest in the best and strive to provide those select few with the best funding and resources possible.

Conclusion – can you get funded for free?

Alright, let's dive into the conclusion, shall we? So, the burning question is: can you snag yourself a free prop firm account? Well, here's the deal. While free accounts do exist in the prop trading world, there might be some better options out there. Trustworthy firms usually ask their traders for the guarantee of a small fee. Be wary of prop firms promising millions and asking for nothing in return – as this is unlikely to be the reality of their business model. But don’t be disheartened: funded trading programs are for real and countless traders have been given a leg up in this way. A prop firm can be your ticket to reliability and success, so long as you choose the right company to team up with. Remember, it's essential to channel your inner Sherlock Holmes and conduct a thorough investigation with some serious due diligence before making any commitments. Happy hunting!

FAQs on Most Affordable Prop Firms

Yes, most prop trading firms charge a monthly fee to give you access to a funded trading account. They are taking a risk by letting you use their capital, so the fee helps balance things out.

Typically, prop trading firms charge a monthly subscription fee ranging from $150 to $25,000. But remember, always compare the fees and benefits offered by different companies before taking the leap.

This depends on the prop firm, and how you sign up. When you trade without evaluation, the profit split with prop firms can be less favorable. If you have passed the evaluation, they might take just 20% of your profits. However, if you join without the evaluation, some companies will take up to a 50% share.

Prop trading firms typically take a cut of 20% to 50% from each trader's profits. They might also charge fees to open accounts. Some generous firms have a 90:10 profit split, where they only take 10% if you make a profit. Keep an eye out though, as some may require you to pay for training and expert coaching.

Absolutely! With a good quality funded trading program, you not only get access to the capital you need but also learn from seasoned traders, gaining invaluable experience and honing your skills while enjoying a steady income.

The salary range for prop traders is $42,373 to $793,331, depending on their skills and experience. The median salary sits at $203,679. The middle 57% earn between $203,679 and $400,084, while the top 86% rake in a cool $793,331. Beginners may start lower during the evaluation stages, but hey, we all have to start somewhere!

Sure, many prop trading firms aren't overly strict about qualifications, education level, or trading experience. They often seek out inexperienced traders, molding them to fit their requirements and trading strategies. It's a chance to learn and grow under their guidance.