Regulatory framework for investment firms

The regulation of a financial institution is the oxygen to its investors. Traders should consider regulatory frameworks and thorough supervision of platforms as a virtual lifeblood to the longevity of their finances. After all, regulation and proper checks and balances could be the foundation of an individual’s portfolio and savings therein. On the macro level, effective regulation strengthens national economies and reduces the probability and severity of financial crises.

Regulation is intended to protect participants of financial markets and to ensure stability and integrity of the system. It is the foundation that gives investors the confidence to participate.

Page Contents

- 1. Regulatory framework for investment firms

- 2. What about prop firms?

- 3. Pass the Challenge: The business Model

- 4. What is the catch?

- 5. How to Choose your Prop Firm

- 6. Who is behind the wheel? Meet the CEOs

- 7. Conclusions and Recommendations: Necessary Steps to Protect Your Interests

- 8. FAQs on Prop Firms trustworthy

View more

According to a study conducted by the International Monetary Fund (IMF), countries with stronger regulatory frameworks and effective supervision have experienced fewer banking crashes. From international banks to independent brokerages, well-regulated systems promote transparency, minimize risk, and safeguard the interests of investors and consumers.

What about prop firms?

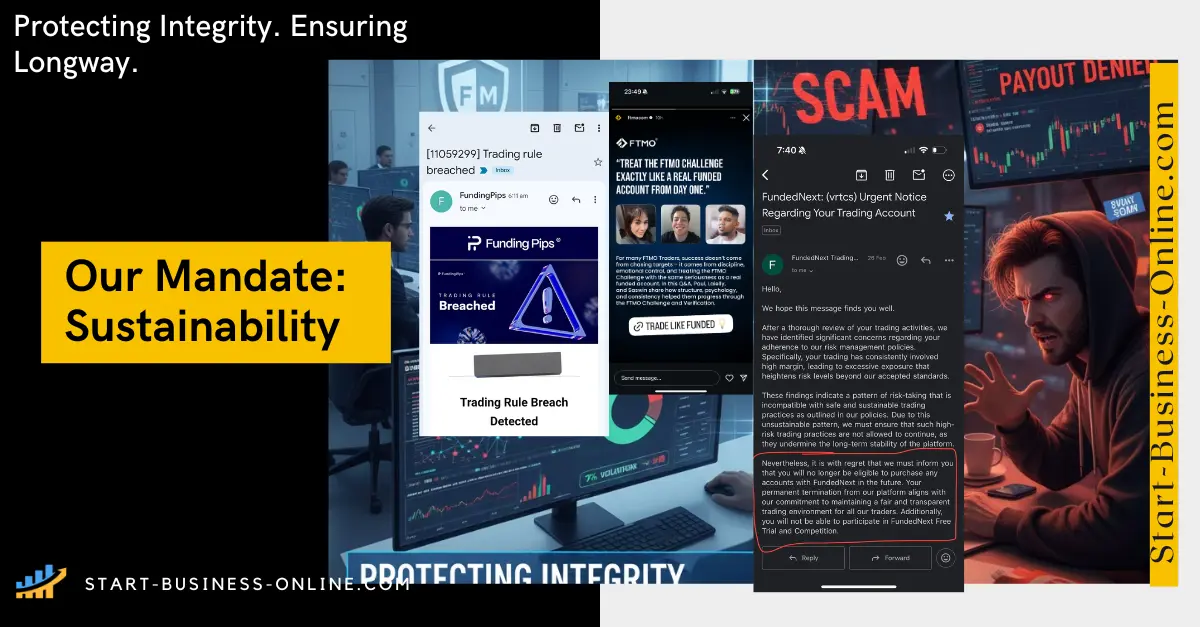

Prop firms – the hype funding platform – are famously in a grey area of regulation. Many traders have been caught unawares by the invisible strings attached to the promise of funding from a prop firm. As is often the case in finance and beyond, where there is opportunity there will also be risk. Where great profit potential exists greed will not be far behind, and the prop firm industry is no exception to the rule. Unfortunately, the individual cases of certain unsavory prop firms have sullied the image of the industry for some traders.

For any readers unsure of the terminology, prop firms or "proprietary firms" are platforms that offer funding to traders. Sometimes up to millions of dollars in company capital, the profits from funded accounts are distributed between firm and trader, with the trader usually keeping the lion's share. The risk of any associated losses is assumed by the prop firm.

Pass the Challenge: The business Model

To recap: prop firms offer traders vast amounts of company capital, with minimal risk and majority gain - are prop firms for real? While alarm bells may sound for someone who feels this is “too good to be true” remember that proprietary firms do not simply dish out funds to any trader who knocks on their proverbial door. Interested traders seeking leverage will first need to demonstrate their ability to meet consistent targets within the parameters of risk.

To assess applicants, prop firms will often use an internal evaluation or series of tests, sometimes referred to as a "Challenge." Traders will pay a small fee to access a trading account, and often throughout a limited period, they will need to meet certain criteria such as profit targets, maximum daily and overall drawdown, and observe trading regulations such as the Consistency Rule. Traditionally, participants of a funded challenge will trade with a demo account using virtual funds.

Those who demonstrate sufficient trading ability will then pass onto the verification stage and be funded with company capital, using real money in live accounts. From this point on, any profits earned will be split between the firm and trader – and this is a legitimate source of funding for many traders.

Funded traders benefit from more than just company capital: as the industry grows bigger by the day, many prop firms are seeking to keep their competitive edge by offering extra features to their traders, including in-house mentors, tutorials and webinars, professional training schemes, and competitions with cash prizes.

What is the catch?

Many traders have effectively used prop firms for instant capital: sometimes paying an extra fee for a “fast-track” account that enables them to begin trading larger accounts and profit accordingly. The experience of trading with hundreds of thousands of dollars – albeit in a demo account initially – can be invaluable to traders seeking to learn the ropes or practice a new strategy without investing their funds. However, traders should be aware that regulation and prop firms do not go hand in hand.

Prop firms are not the Fairy Godmothers of funding – a business model designed to only give away money would send off red flag warnings. Prop firms do collect funds, not only from the shared profits of the recruited traders using company capital but also from the failed challenge fees.

How to Choose your Prop Firm

Other prop firms take their cut by charging fees from traders. Regulation is important in prop trading and most prop firms are not regulated, which means there are no strict rules to protect traders. So, it is up to you to figure out if a prop firm is trustworthy or not.

The regulatory grey area enjoyed by many prop firms opens them up to multiple means of generating dividends from their funding model. How can you evaluate the trustworthiness of a prop firm and spot a scam prop firm?

- Reviews: To find a good prop firm, check ratings and reviews from other traders. Check trusted review platforms, online forums, and social media channels. Pay attention to both positive and negative reviews. But be wary of fake reviews. Established firms with positive feedback are safer bets. Well-established prop firms with a solid reputation and positive feedback are generally safer choices.

- Website: Also, look at the firm's website. Legitimate ones have well-designed sites with clear information. If it looks sketchy and has mistakes, it might be a scam.

- Rules: Check the requirements and limitations set by the prop firm. If they are too strict or too easy, it is a red flag. Legitimate firms want to fund successful traders without taking on too much risk.

- Support: Good customer support is crucial. Legit prop firms value their traders and provide excellent service. If they have bad or no customer support, stay away.

- Partnerships: Check if the prop firm has partnerships or affiliations with reputable financial institutions, industry organizations, or educational providers. Strong business relationships with recognized industry names are a good indicator of credibility and transparency.

- Track record: Take stock of the firm’s experience in the industry. Look for information about their past performance, and the success rate of their funded traders. A long-standing and reputable firm is generally more trustworthy than a newly established one.

Who is behind the wheel? Meet the CEOs

The most accurate reflection of the quality and longevity of a prop firm will be found neither in review sites nor in their Challenge small print. The most important litmus test of any prop firm is often the least common one: who is their CEO? The proof is in the pudding: successful companies have strong leaders at the helm. Numerous studies have demonstrated that high-performing CEOs experienced higher returns on assets and higher stock returns compared to firms with underperforming CEOs. Good leadership inspires positive financial performance and shareholder value.

Consulting gurus PricewaterhouseCoopers (PwC) recently published an eye-opening new study: companies with transparent and effective CEO communication experienced higher employee engagement and retention rates. In other words, CEOs who keep the communication channels open and keep things above board have happier employees who are in it for the long haul. This is critical in the financial industry where talent and expertise give companies their edge over competitors.

A CEO who can communicate with their team can be a game-changer and lead to a positive “trickle-down effect.” Prop firms with a leader who can represent the company's vision, values, and goals will inspire and motivate employees and traders, leading to increased productivity and performance. The most important value in a CEO is transparency: where there is trust there is longevity, and this fosters growth and investment.

Meet the CEO of FunderPro Prop Firm

Gary Mullen, the CEO of FunderPro, and his dedicated team have made significant strides in the proprietary trading firm industry. Their relentless efforts have led to the creation of a groundbreaking challenge that is poised to be “a game changer”.

By eliminating complicated trading rules and providing traders with unlimited time, FunderPro is transforming the trading landscape. With a focus on empowering traders and fostering growth, Gary aims to provide real value and opportunities for participants to showcase their skills and compete for capital gains. As an STP platform, FunderPro aligns its success with the success of traders. Under Gary's leadership, FunderPro is reshaping the prop trading landscape, offering a simpler and more rewarding trading experience for traders worldwide.

Prior to his role as CEO of FunderPro, Gary Mullen demonstrated his exceptional abilities as the Chief Commercial Officer of Red Acre Group. His strategic vision and expertise in commercial strategy, marketing, and sales played a pivotal role in driving remarkable revenue growth and expanding the company's market presence. Equipped with a wealth of experience and a proven track record, Gary brought invaluable insights and leadership to his position at FunderPro, setting the stage for continued success and innovation.

Meet the CEO of FunderPro Futures Prop Firm

The FunderPro Futures program is overseen by Gary Mullen, the visionary CEO behind FunderPro’s flagship forex brand. Leveraging his background as Chief Commercial Officer at Red Acre Group, Mullen spearheaded the pivot into futures to capture traders who thrive in CME’s deep liquidity. His mandate: simplify rules, eliminate deadlines, and share profits generously.

Meet the CEO of Funding Pips Prop Firm

Khaled Ayesh's story is one of perseverance and adaptability. Born in Amman, Jordan, Khaled faced early challenges that shaped his resilience. At 17, he moved to Germany for higher education, starting in Mechanical Engineering before switching to Finance at SRH Hochschule Berlin. It was during his studies that Khaled discovered his passion for trading, which would define his career.

With a Finance degree and a passion for trading, Khaled founded Funding Pips, a proprietary trading firm. He aimed to address the industry's issues, such as long payout cycles and poor user treatment. His leadership introduced weekly payouts and a focus on user satisfaction, transforming the proprietary trading landscape and setting new industry standards.

Meet the CEO of FXIFY Prop Firm

David Bhidey and Peter Brown are the co-founders of FXIFY, a proprietary trading firm. David Bhidey has a decade of experience in technology and e-commerce, having founded an online property company. His transition into trading five years ago, along with his role as an Introducing Broker at FXPIG, laid the foundation for FXIFY. With a strong focus on technology and finance, David aims to make FXIFY a trader-centric platform, emphasizing profitability and innovation.

Peter Brown, with over ten years of experience in e-commerce and marketing, also transitioned into trading, partnering with David at FXPIG. His expertise in performance marketing and website development has been key to FXIFY's rapid growth. Together, David and Peter have built FXIFY into a leading firm that prioritizes trader success and market excellence.

Meet the CEO of FundedNext Prop Firm

Abdullah Jayed is the Founder and CEO of FundedNext and NEXT Ventures. Abdullah Jayed attended North South University.

Jayed has gained prominence for his successful ventures, including Growth Alliance, MoneyBackFX, and eComChef, which swiftly became market leaders in their respective domains. Building on his track record, he founded FundedNext, a multi-million dollar proprietary firm that is revolutionizing the prop firm industry on a global scale.

A strong advocate for supporting young and passionate individuals in pursuing their dreams, Jayed shares his values and works to empower others in their entrepreneurial journeys.

Meet the CEO of FTMO Prop Firm

Otakar Suffner is the CEO of FTMO, who was born and raised in Prague. He believes you don’t need a university education to be a good trader or businessman, although it certainly helps. This was due to having a smaller account since his options were minimal then.

As a co-founder of FTMO, a dynamic and ambitious company, Otakar and his team actively seek out and financially support trading talent in financial markets. Prior to launching FTMO, Otakar dedicated three years to full-time trading before deciding to fully commit to the project.

In his approach to trading, Otakar is highly analytical and data-driven, placing great emphasis on statistics. He leans towards probability-based strategies, leveraging numbers to develop unique and innovative trading ideas.

Meet the CEO of Apex Trader Funding Prop Firm

Darrell Martin, founder of Apex Trader Funding, began his trading career as a self-taught trader, inspired by the birth of his first child and the need to generate additional income. Attending motivational seminars sparked his interest in market dynamics, and despite lacking initial knowledge, he committed to learning the craft. Through courses and mentorship from experienced traders, Martin became a profitable trader. His struggles with funding led him to establish Apex Trader Funding, providing opportunities to traders like himself. Martin also founded ApexInvesting.com, a trading community with over 30,000 members globally.

Meet the CEO of the5ers Prop Firm

Gil Ben Hur is the founder and CEO of The5ers.com Funding Traders & Growth Program which is an innovative transformation for the classic proprietary trading fund model. He has been a full-time individual Forex trader since 2007, specializing in Orderflow and Price-Action methodologies. Mr. Ben Hur is also a trading coach and a former private investors portfolio manager. In 2016, he launched The5ers.com, a unique trading-career-platform that caters worldwide forex traders, by providing significant trading capital and a fast-paced trading career growth.

Meet the CEO of NeomAAA Funds Prop Firm

Amira Al‑Sayegh, CEO and former CME energy‑desk risk officer, heads NeomAAA Funds. Her mandate: keep rules few, payouts fast, and performance data transparent. She hosts quarterly livestreams where funded traders share tactics and results.

Meet the CEO of Top One Futures Prop Firm

The founders—ex‑floor traders who keep a low profile—host quarterly webinars showing aggregated desk performance without revealing proprietary strategies.

Meet the CEO of Take Profit Trader Prop Firm

CEO and floor‑trading alumnus Michael Brenner spearheaded the launch of Take Profit Trader after 15 years in S&P pit arbitration. Brenner’s mission: create a funding product that mirrors prop‑desk discipline without corporate bureaucracy.

Meet the CEO of ThinkCapital Prop Firm

Leadership team not publicly listed; company registered in Florida with a global remote support staff.

Meet the CEO of Hola Prime Prop Firm

CEO details not yet public. Hola Prime is registered in the UAE as Hola Prime Technologies LLC.

Meet the CEO of MyFundedFX Prop Firm

Matthew Leech, the founder and CEO of MyFundedFX, is a successful entrepreneur with extensive experience in the financial and tech services sectors. A skilled trader himself, with expertise in forex, options, stocks, and cryptocurrencies, Matt has been actively trading since 2018.

His motivation to launch MyFundedFX arose from identifying a gap in the proprietary trading industry, where many firms often overlook the needs of individual traders. In addition to his role at MyFundedFX, Matt is involved in several other ventures, showcasing his dedication to fostering innovation and growth within the trading community.

Meet the CEO of Topstep Prop Firm

Michael Patak is a Founder and CEO at Topstep. He is a financial markets professional based in Chicago and a former floor trader and member of the Chicago Mercantile Exchange. He is best known as the founder and chief visionary officer of Topstep Trader, an educational and funding platform designed for new traders.

Previously he was the founder of Gorilla Gamer.

In 2016, Patak was a finalist for the Ernst & Young EY Entrepreneur Of The Year® 2016 Award in the Midwest, which encompasses Illinois and Wisconsin.

Meet the CEO of Blue Guardian Prop Firm

Sean Baiton, the CEO of Blue Guardian, brings years of trading expertise and deep experience in the proprietary trading firm industry. With a solid understanding of the field, Sean offers a wide range of trading services, including signal provision, machine learning, and quantitative analysis for developing trading bots.

Under Sean''s leadership, Blue Guardian has developed a strong strategy to achieve both short and long-term goals. His pivotal role in shaping and executing the company's vision and mission has been instrumental in the firm's establishment and ongoing success.

Meet the CEO of Funded Trading Plus Prop Firm

Simon Massey is the CEO of Funded Trading Plus. Originally pursuing a career as a first responder, he discovered that this path did not align with his long-term goals. After a decade in emergency services, Simon took a leave to explore alternative career options. Inspired by his friend Pasha, a former Wall Street trader, Simon shifted his focus to finance and began trading full-time.

Alongside his trading career, Simon co-founded Trade Room Plus with Michael to mentor and support aspiring traders. Funded Trading Plus was born from the realization that significant trading capital, like that which Pasha had access to, could greatly benefit individual traders. The firm aims to provide opportunities for traders to work with larger amounts of capital that would otherwise be out of reach.

Meet the CEO of Plutus Trade Base Prop Firm

Information about the founders or executive team of Plutus Trade Base is not publicly disclosed.

Conclusions and Recommendations: Necessary Steps to Protect Your Interests

Making money with prop firms is possible if you are a skilled and consistent trader with a proven strategy. But keep in mind that prop firms only fund a small percentage of traders. You need to meet their criteria and align with their trading style. And remember, evaluation is a two-way street: you need to assess whether your choice of prop firm is a sensible one and prudent for your long-term financial success.

When evaluating the risk associated with trading with a prop trading firm, several key factors should be considered. These include the firm's regulatory status, track record, industry reputation, and level of transparency. Conduct thorough research on the firm's history, financial stability, risk management practices, as well as information about their CEO and Founder. Additionally, be vigilant for any potential conflicts of interest. Seeking legal advice is advisable to gain a deeper understanding of the risks involved and to safeguard your interests.

FAQs on Prop Firms trustworthy

Prop firms are in a grey area of regulation. Unfortunately, many traders have been caught unawares by the invisible strings attached to the promise of funding from a prop firm. There are several ways to check and see if your Prop trading firm is legit. Always do your homework beforehand.

There aren't any major regulatory restrictions on prop trading firms and many operate outside the realm of traditional regulatory frameworks. This lack of oversight can lead to increased risks for traders who engage with these firms. It's crucial for individuals to thoroughly research and understand the regulatory status of a prop trading firm before considering any involvement.

Yes, prop firms are generally considered higher risk than trading with a traditional broker. This is primarily because prop firms often lack the same regulatory protections and oversight that traditional brokers have. Consequently, traders who engage with prop firms may face a greater risk of loss or potential misconduct.

To assess the risk of trading with a prop trading firm, consider factors such as their regulatory status, track record, reputation in the industry, and the level of transparency they provide. Research the firm's history, financial stability, risk management practices, who is their CEO and Founder and finally any potential conflicts of interest. It's advisable to seek legal advice to better understand the risks involved and protect your interests.