“Time is the devourer of all things.” Ovid may not have been referring to a prop trading challenge, but the observation of this Roman poet rings as true in the 1st century as in the 21st. We have all been on the receiving end of Time: missing a train or a flight; failing to finish an exam paper before the bell to stop writing, arriving at the office ten minutes after your first meeting has begun. They say that time waits for no man, and it certainly waits for no prop trader.

Prop Trading – the Latest Avenue to Funding

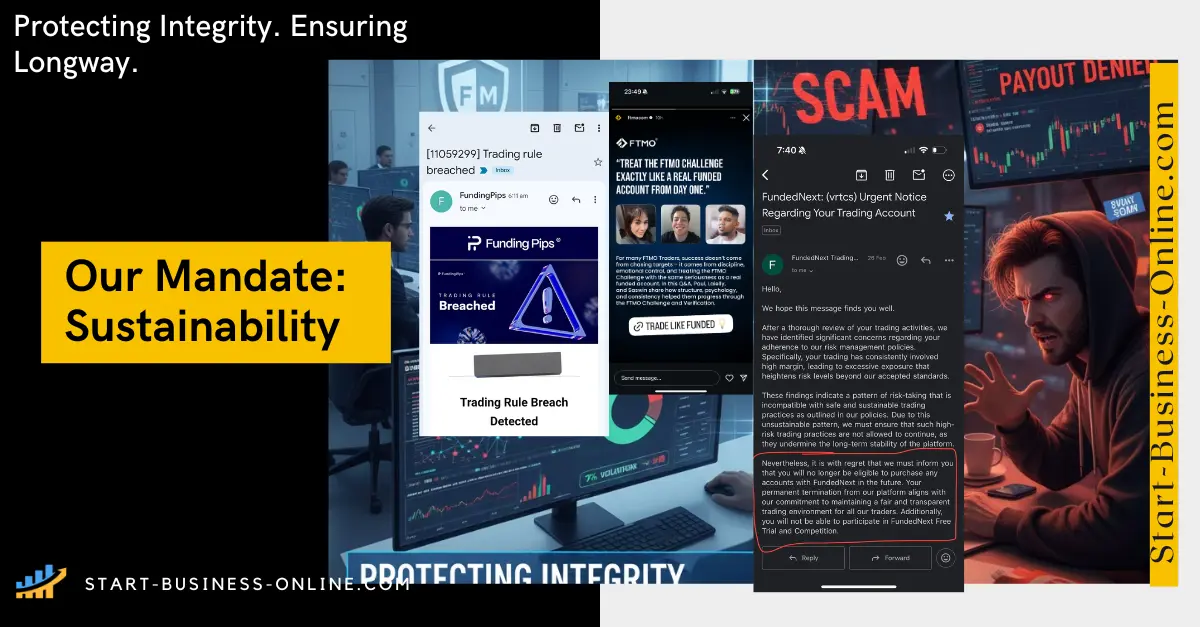

Prop trading is an increasingly popular way for underfunded traders to access the use of company capital – vastly magnifying their potential profits and enabling them to diversify their portfolios and leverage new strategies with greater positions. Prop firms do not dispense money to any trader, however: far from being a vending machine for capital they are a sought-after venue for funding for ambitious traders seeking to grow their accounts and advance their careers. Simply put, everyone might want to be a funded trader, but prop firms will not fund every trader. Prop firms, or “proprietary trading firms” need to assess the profit potential (and risk liability) of the traders to whom they entrust their company capital. In order to evaluate the most talented traders or those with the greatest future potential, prop firms will use a trading test or “Challenge.”

Evaluations vary from firm to firm, but as a rule of thumb traders will need to trade within certain parameters, reaching profit targets without excessive losses. Traders may need to demonstrate their ability to make steady returns by observing the “Consistency Rule,” while others may stipulate restrictions on certain trading styles or forbid the use of expert advisors. Many – far too many some traders might say – also have time limits.

The Impact of Time on Performance

When it comes to performance and time, there are far more examples of foes than friends. In other words, most people do not improve with deadlines. From an employee fumbling through a company presentation as he glances at the clock, an otherwise brilliant athlete missing a goal in the final minutes of a match, through to a driver crashing as they tried to beat a red light – time constraints do not tend to improve our outcome.

In the realm of high-stakes situations, deadlines can add pressure which is detrimental to progress. As the clock ticks away, the stumbling blocks of distractions and fumbled decisions increase. Why time limits and success can feel like opposite train tracks is difficult to pinpoint exactly: there could be myriad psychological, physiological, and cognitive factors at play. Of course, there are some individuals who thrive under time pressure and find their performance not only unchanged but sometimes improved. When it comes to prop trading challenges most traders would agree – rushing your strategy leads to suboptimal progress.

Challenges of Prop Firm Time Limits

- Increased Pressure: Time limits add significant pressure on traders as they need to achieve specific profit targets within a set timeframe, leading to heightened stress and potential decision-making biases.

- Rushed Decision-Making: Traders may be compelled to make quick decisions under time constraints, which can lead to impulsive and substandard trading choices without thorough analysis.

- Reduced Risk Management: The focus on meeting profit targets within a limited period may cause traders to neglect proper risk management practices, leading to higher exposure and potential losses.

- Limited Market Opportunities: Time limits restrict the ability to wait for optimal market conditions or seize long-term opportunities, potentially limiting profit potential and overall trading performance.

- Emotional Impact: The time pressure can trigger emotional responses such as anxiety, frustration, and fear, impairing traders' ability to think objectively and execute trades effectively.

- Inadequate Learning Opportunities: Time-limited challenges may not allow traders to gain valuable experience and learn from market fluctuations, as their focus is primarily on meeting short-term targets rather than long-term skill development.

Of course, it is important to note that the time period of a Challenge is not an accidental oversight: many prop firms deliberately add the deadline to test traders' abilities to perform under pressure. The reality is, however, that many successful traders took their time and had the profits to show for it. A prop firm challenge is designed to be just that: challenging, but some traders would argue that the limitations on permitted strategies, drawdown limits, and profit targets prove enough opportunities to demonstrate one’s ability as an exceptional trader with great profit potential. For certain traders, the added pressure of doing all the above within (perhaps too short a) period is an excessive handicap. If you’re one of them, you may prefer these Top Prop Firm Challenges for Low-Risk Traders built around generous timeframes and calmer decision-making.

For these traders, there is another way: prop firms with unlimited time Challenges! The new company FunderPro may be the trailblazer here, but increasingly, prop firms are offering traders the chance to demonstrate their profitability and risk management without the added constraint of a time limit.

Here is the list of Prop Firm Challenges with No Time Limit

| Prop Firm | Unlimited Time Accounts |

|---|---|

| FunderPro | |

| FunderPro Futures | (No evaluation deadline) |

| Funding Pips | (Only with the Knight challenge) |

| FundedNext | (Only with Express model and One-step/Two-step Stellar challenge) |

| FTMO | |

| Bullwaves Prime | |

| the5ers | |

| SabioTrade | |

| NeomAAA Funds | (No time limit on challenges) |

| Hola Prime | (No deadlines) |

| ThinkCapital | (No evaluation deadlines) |

| UltraCap Trading | (Standard & Royal challenge are the two-phased evaluation with no time limits.) |

| TX3 Funding (Toptier Trader Rebrand) | |

| Blue Guardian | (Only with the "Unlimited Guardian" account) |

| FTUK | |

| Funded Trading Plus | |

| City Traders Imperium | |

| E8 Markets | |

| Lux Trading Firm | |

| Goat Funded Trader | (Only with the No time limit Challenge) |

| Tradexprop | (No evaluation deadlines) |

Conclusion

Trading is an adrenalin-fueled industry: the stakes are high, and success is often contingent on the ability to make loaded decisions against the clock. Scalpers, in particular, will find the ability to make frequent and fast market decisions the best way to stay ahead of a price trend and profit accordingly. Not every trader is driven by speed, however, and other strategies will require careful consideration over a prolonged period to capture an overview of the market and trade accordingly. Now that these prop firms are offering unlimited time to complete their evaluations, the playing field has been leveled and traders of all abilities and strengths have the chance to secure funding and maximize their potential.

Looking for a faster-paced environment instead? Explore our Higher-Risk, Higher-Reward Prop Firm Challenges designed for aggressive traders who thrive under pressure.

FAQs on Unlimited Time Prop Trading Firms

Yes, FTMO has a maximum time duration of 30 days. Lately you can extend your FTMO Challenge by 14 extra calendar days before taking a free repeat! (Check FTMO General Terms & Conditions)

According to the firms business plan they are after for consistent, responsible risk managers. Putting a time constraint on traders encourages over-leveraging and over trading.