Introduction

In late August, the Forex trading world was shaken when U.S. and Canadian regulators shut down My Forex Funds, a prominent and vastly popular Forex prop trading firm. Since then, not much has changed regarding the My Forex Funds saga, however in the aftermath of this development the entire prop trading industry is already being faced with significant transformations. In this article, we'll delve into what's been happening with my Forex funds, how prop firms are adapting, the challenges they're encountering, and new avenues for prop traders.

The My Forex Funds Conundrum

Many My Forex Fund traders have been anxiously waiting for updates on their investments since the shutdown. Some were hopeful of receiving payouts or refunds for their challenges, especially since the company initially indicated that it would reach out to regulators to discuss their concerns. However, it was clear from the start that this situation would require a lengthy process prior to any resolution. We had advised from the onset those facing challenges to contact their credit card companies, and some have successfully reclaimed their funds through this method. The preliminary court hearing for My Forex Funds on September 11th in New Jersey passed with no major developments or announcements. While the accusations against the company are based on findings specifically pertaining to the brand and the people behind it, it's evident that regulators are considering changes that could affect the entire prop trading industry. The road ahead remains uncertain, as the Ontario Securities Commission has extended the temporary order and postponed the relevant hearing until October 30th.

Deel's Industry-Wide Compliance Review

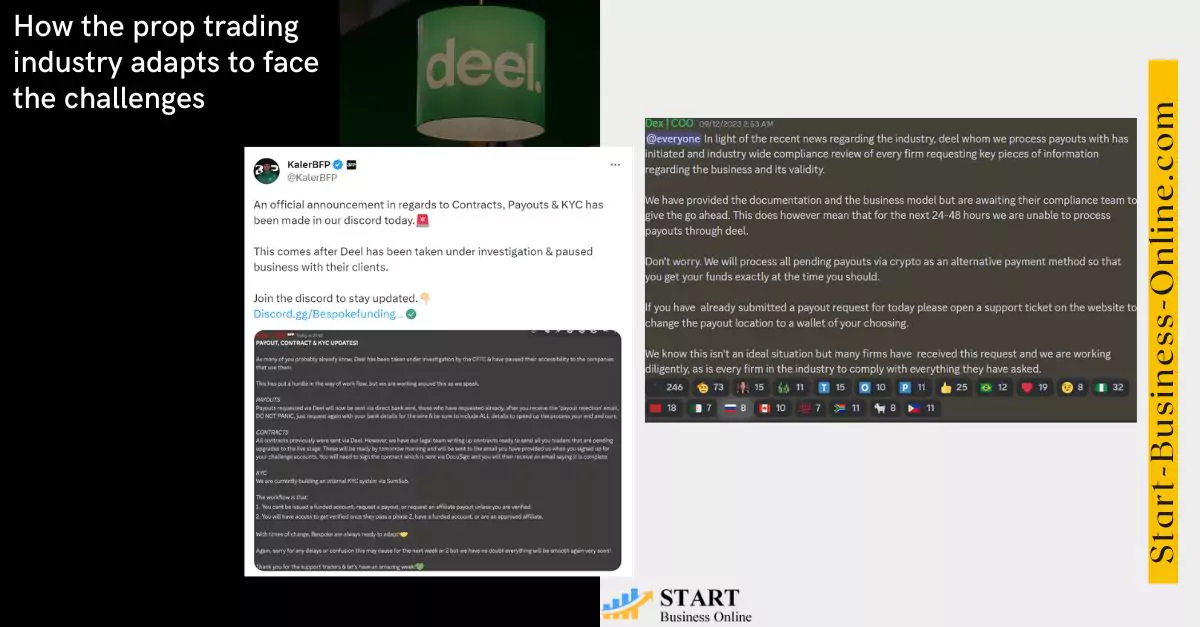

The situation with My Forex Funds has sent ripples throughout the entire prop trading industry. Deel, a primary payment provider for many prop firms, halted payouts, confirming that this is an industry-wide issue. This comes in response to the fact that Deel is currently under investigation by the CFTC for facilitating over $72 million in payments for My Forex Funds in the past year.

While not all prop firms have had their payments affected, a significant number have by their own admittance. Deel claims to be working to resolve these issues swiftly, conducting compliance reviews. This development is yet another signal that prop trading firms will inevitably be forced to make proactive changes to anticipate potential regulatory adjustments.

An executive at MyFundedFX, who identified himself as the firm's chief operating officer, dropped a bombshell on Discord, a popular communication platform when he revealed that, for the next 24 to 48 hours, the company would be unable to process payouts through Deel. This sudden development was attributed to Deel's initiation of an "industry-wide compliance review." The implications of this pause in payouts are far-reaching, impacting both prop trading firms and their traders. Moreover, Lewis Kaler, the CEO of Bespoke Funding, via a post on Twitter, confirmed Deel's suspension of access attributing it to an ongoing investigation involving Deel by the Commodity Futures Trading Commission (CFTC).

The Broader Impact on the Prop Trading Industry

While the focus is currently on Deel, the broader implications of this incident cannot be underestimated. The prop trading industry is closely intertwined, with payment providers serving as vital links in the financial chain. The outcome of this situation may prompt prop trading firms to reconsider their reliance on specific payment providers and urge them to seek more diversified financial solutions.

Adaptations in the Prop Trading Industry

The announcement of Deel's suspension of payouts and the CFTC's investigation into My Forex Funds and related entities has sent shockwaves through the prop trading industry. As the industry grapples with uncertainty, prop trading firms and traders alike must adapt to this new reality. The incident underscores the importance of regulatory compliance and the need for robust financial infrastructure within the industry. It further highlights that those not willing to change and adapt to the evolving landscape and regulatory pressures will be faced with demise. Admittedly, the industry has shown good reflexes which may be seen in the following five ways through which prop firms are adjusting to the new environment:

- Language Changes

- Diversification into Futures

- Exploring New Ways to Get Funded

- Legal Preparedness

- Diversifying Payout Methods

Let's explore those five ways through which prop firms are adjusting to the new environment in more detail:

Language Changes

Many prop firms have altered the language used on their websites. From funded engineer to bespoke funding and my funded FX, for instance, have changed terms for example their challenges are now referred to as "simulated accounts," and targets and losses are characterized as "virtual profit targets" and "virtual profit losses." This shift towards gamification is more like a way to hide profit payouts which are still happening but they're being called virtual profit payouts.

Diversification into Futures

Some prop firms are exploring Futures prop trading as an alternative or more stable business model. This shift is partly in response to one of the main CFTC charges against My Forex Funds – manipulating the price feed. Futures prices come from the Chicago Mercantile Exchange, offering more transparency compared to the decentralized Forex exchange.

We've prepared a detailed guide for you regarding some of the most popular prop firms and their financial instruments offers including the ones that are currently offering Futures prop trading.

| Prop Firm | Futures |

|---|---|

| FunderPro Futures | (Equity Futures, Foreign Exchange Futures, Agricultural Futures, Energy, Interest Rates Futures, Metals Futures) |

| Apex Trader Funding | (Equity Futures, Foreign Exchange Futures, Agricultural Futures, Energy, Interest Rates Futures, Metals Futures) |

| Top One Futures | (Equity Futures, Foreign Exchange Futures, Agricultural Futures, Energy, Interest Rates Futures, Metals Futures) |

| Take Profit Trader | (Equity Futures, Foreign Exchange Futures, Agricultural Futures, Energy, Interest Rates Futures, Metals Futures) |

| Topstep | (Equity Futures, Foreign Exchange Futures, Agricultural Futures, Energy, Interest Rates Futures, Metals Futures) |

| Elites Funding | (Equity Futures, Foreign Exchange Futures, Agricultural Futures, Energy, Interest Rates Futures, Metals Futures) |

| Earn2Trade | (Equity Futures, Foreign Exchange Futures, Agricultural Futures, Energy, Interest Rates Futures, Metals Futures) |

| Goat Funded Trader | (Equity Futures, Foreign Exchange Futures, Agricultural Futures, Energy, Interest Rates Futures, Metals Futures) |

| The Trading Pit | (Equity Futures, Foreign Exchange Futures, Agricultural Futures, Energy, Interest Rates Futures, Metals Futures) |

Exploring New Ways to Get Funded

Prop traders are discovering new avenues to secure funding. Companies like Darwinex use the z-score to measure the quality of a trader's return, determining how much funding they receive. Axi, a major CFD broker, has introduced Axi Selects, which utilizes an Edge score method. Some firms are even exploring token-based payouts, which could become more common in the future.

Legal Preparedness

Many prop firms are taking legal precautions by retaining counsel and implementing internal and external changes to avoid legal troubles similar to those faced by My Forex Funds.

In one of our previous articles, you can find more information regarding the legal definition and regulation of prop trading. Remember too that what may be true today could be different tomorrow.

Whether you are a prop firm owner or funded trader, the more you stay in the loop of this fast-changing horizon the better for your financial prospects.

Diversifying Payout Methods

In light of recent developments with Deel, prop trading firms are diversifying their payout methods. They now offer alternatives like bank wires and crypto payments to provide more flexibility to traders.

Furthermore, alongside the diversification of payout methods and the introduction of backup processors, there has been a flurry of announcements this week from numerous proprietary trading firms outlining their forward-looking strategies. These initiatives are geared towards regaining the trust of their traders and assuring all customers that they will receive their full payouts within the committed timeframes. This proactive approach underscores the commitment of these firms to maintaining transparency and reliability in their operations, ultimately fostering a sense of confidence and security among their clientele.

As highlighted in our earlier guide, diversification emerges as an indispensable pillar of effective risk management within the world of forex prop trading. However, when it comes to the realm of proprietary trading firms, we find ourselves navigating a vast variety of different payment options for deposit and withdrawal. To stay well-informed and make informed choices, we encourage traders to have a look at our regularly updated table featuring which payment methods are offered by some of the most popular Proprietary Trading Firms.

Conclusion

The saga of My Forex Funds and its subsequent shutdown has ushered in a period of transformation for the prop trading industry. While it's an evolving situation, it's clear that prop firms are adapting to the challenges and uncertainties they face. This could lead to a fairer and more transparent trading environment for all involved, even if it means sacrificing some of their substantial profits. The future of funded prop trading remains uncertain, but it's a space worth watching as it continues to evolve.

Stay tuned for more updates on the prop trading industry and for further developments in this ever-changing landscape.