The Hidden Realities of Payouts No One Talks About

When evaluating prop trading firms, traders are often lured by flashy terms like “daily payouts” or “on-demand withdrawals.” These promises suggest fast, seamless access to your profits—but rarely deliver as advertised. Earlier this year, we broke down the illusion of so-called daily payouts and identified FunderPro’s Daily Rewards account as the only legitimate solution offering genuinely ongoing daily withdrawals.

Now, there’s a new contender in the lexicon of prop trading marketing: “on-demand payouts.” It sounds even better—suggesting instant, frictionless access to your earnings whenever you want. But as with many buzzwords in the industry, what’s promised in bold headlines doesn’t always match the fine print.

This guide unpacks what “on-demand” really means in practice, how it’s applied (and limited) across different firms, and why true payout flexibility remains elusive—except in one place.

For foundational insights, see our earlier report: The Truth Behind Daily Payouts.

What “On-Demand” Actually Means

- True Day-1 On-Demand

Definition: Traders can request a withdrawal immediately after the first profitable live trade—with no lock periods, no minimum profit thresholds, and no required number of trading days.

Reality: This is rare. Few firms actually offer this level of immediate flexibility.

- Conditional On-Demand

Definition: Withdrawals are permitted only after meeting internal performance gates, such as a minimum profit percentage (e.g., ~4% total account profit), a set number of profitable trading days (e.g., 4+), or adherence to “consistency” metrics (e.g., avoiding unusually large trading days).

Reality: These gates create delays disguised as requirements, throttling access to your profits under the guise of “discipline.”

- Scheduled Payouts with “On-Demand” Branding

Definition: You can choose your payout date—but only after a pre-set cooldown/lock period (typically 14–21 days). After that, withdrawals fall into a fixed cadence (e.g., every two or four weeks).

Reality: The flexibility is more cosmetic than functional. Traders remain tethered to a schedule.

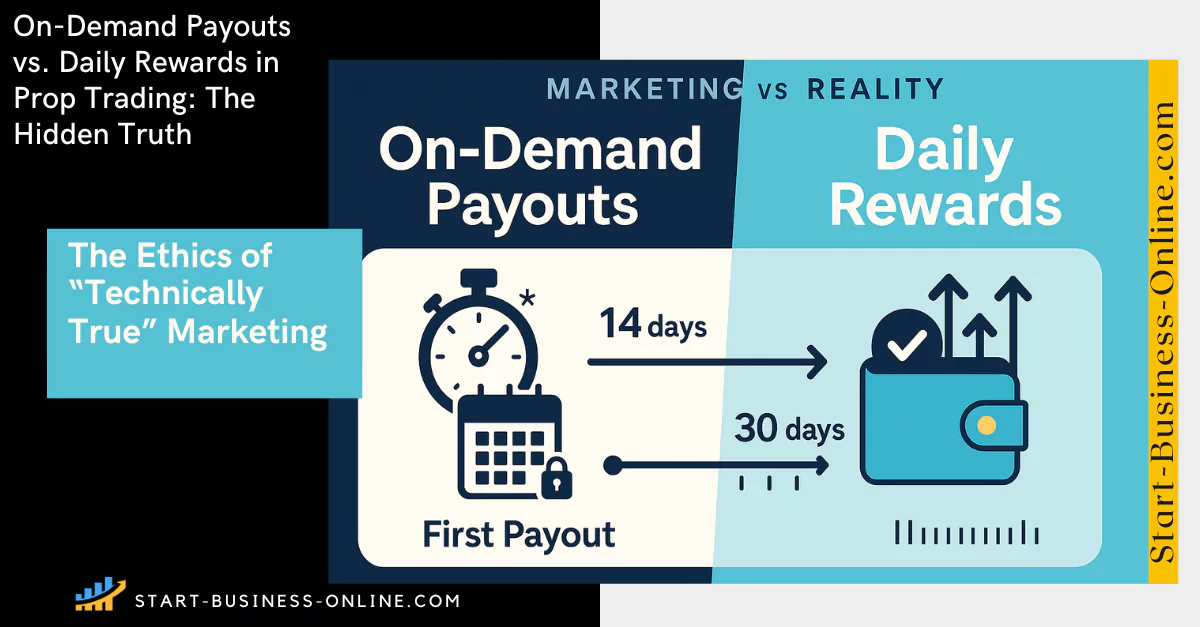

Case Study: A Prop Firm’s “On-Demand” Structure

One major prop firm markets itself as offering “First Payout On-Demand.” A closer reading of their withdrawal policy reveals the limits by account type:

- 1-, 2-, 3-Phase Challenge Accounts: First withdrawal allowed after the first profitable live trade (authentic on-demand). After that, withdrawals revert to a 30-day cycle by default, or a 14-day cycle if the trader pays for a bi-weekly add-on.

- Instant Funding Accounts: First payout available only after 14 days, then bi-weekly.

- Lightning Accounts: First payout after 7 days, then bi-weekly.

Takeaway: The “on-demand” feature exists—but only once. After the first withdrawal, payouts return to a predetermined rhythm unless you pay for faster access.

FunderPro: The Only Prop Firm Currently Offering Real Ongoing Daily Payouts

In contrast, FunderPro’s Daily Rewards account offers what other firms only imply: true, daily, ongoing withdrawals. As long as the account is at least 1% in profit, traders can initiate a payout at any time. There are no lock periods. No performance gates. No forced delay after the first withdrawal. You can even withdraw multiple times in a single day if the conditions are met.

Why It Matters:

- Cash-flow flexibility is essential for active traders, especially those managing risk dynamically.

- Liquidity of profits lets you scale operations, reallocate capital, or take profits more confidently.

- Trust and transparency: when a firm doesn’t hide restrictions behind vague promises, traders can operate with more certainty and autonomy.

That’s why FunderPro remains the gold standard for traders who care about access to their earnings—not just in theory, but in practice.

How Other Firms Frame “On-Demand”

- Blue Guardian: First payout available immediately. Subsequent withdrawals limited to bi-weekly intervals.

- E8 Markets: Advertised “on-demand” is unlocked only after meeting strict criteria: 4 profitable days, ~4% profit target, and “consistency” rules limiting volatility in trade performance.

- Alpha Capital Group: Requires a ~2% profit minimum and a best-day cap—one outsized day can invalidate payout eligibility.

- FTMO: First withdrawal available 14 days after the first funded trade; thereafter monthly or bi-weekly (14-day) cycles.

- FundedNext: First withdrawal after 21 days; thereafter bi-weekly.

Quick Comparison: Who Actually Delivers?

| Firm | First Payout | After That… | True Daily Payouts? |

|---|---|---|---|

| FunderPro (Daily Rewards) | Anytime (≥1% profit) | Daily possible (even multiple/day) | ✅ Yes |

| FXIFY | Day-1 (1/2/3-Phase); 14d (Instant); 7d (Lightning) | 30-day cycle or 14-day with paid add-on | ❌ No |

| Blue Guardian | Day-1 | Bi-weekly | ❌ No |

| E8 Markets | After profit/consistency gates | Gated withdrawals | ❌ No |

| Alpha Capital Group | After profit + best-day cap | Gated withdrawals | ❌ No |

| FTMO | After 14 days | Monthly or 14-day cycle | ❌ No |

| FundedNext | After 21 days | Bi-weekly | ❌ No |

Key Takeaways: What Traders Should Know

- “On-demand” is frequently a first-payout-only feature—great for marketing, limited in practice.

- Subsequent withdrawals often revert to rigid cycles—either 14 or 30 days, with limited exceptions.

- Add-ons for faster cadence are increasingly common and can erode overall profitability.

- FunderPro stands alone in offering unrestricted, ongoing daily payouts without gating mechanisms, lock periods, or mandatory add-ons.

Final Thought

If you value flexibility, liquidity, and control over your trading profits, you need more than buzzwords—you need policies that align with your strategy. Before choosing a prop firm, read the fine print. Verify the payout structure. Don’t settle for “on-demand” when you can have the real thing.

Need help evaluating current offers or comparing firms? Check our live coupon board for exclusive deals and real-time updates.

Frequently Asked Questions (FAQs)

In prop trading, “on-demand” usually means you can request your first payout immediately after making profit. However, in most firms, only the first payout is instant, with all future withdrawals reverting to fixed cycles (14–30 days).

As of 2025, only FunderPro’s Daily Rewards account offers genuine daily payouts, allowing multiple withdrawals per day once the account is 1% in profit.

No. For the big majority it allows the first payout instantly after your first profitable trade, but subsequent payouts are restricted to 30 days (14 days with an add-on). Instant Funding and Lightning accounts have 7–14 day waiting periods even for the first payout.

Yes. “On-demand” is often a one-time perk, while “daily payouts” (like FunderPro’s Daily Rewards) allow consistent withdrawals anytime profits are available.

Many firms use the first on-demand payout as a marketing hook, but revert to longer cycles to manage cash flow, reduce fraud risk, and encourage account scaling.