Showing Results: 1 - 21 / 152

Prop Firms, Trustpilot and “Breach of Guidelines” Warnings

In the prop-firm boom, Trustpilot has become one of the first places traders look before buying a challenge. A long list of five-star reviews can feel like a ...

Prop Trading Thailand: Best Firms, THB Costs, SEC/BOT

Prop trading in Thailand is moving from niche to mainstream as traders in Bangkok, Chiang Mai, and Khon Kaen look for scalable capital, disciplined rulebooks, and ...

Filter vs. Betrayal: Analyzing the Prop Firm Reckoning

⚔️ The Great Filter vs. The Great Betrayal: Analyzing the Prop Firm Reckoning Executive Summary At-a-glance overview FocusCore ConflictKey Data ...

Prop Trading in Vietnam: Rules, Costs (VND), SSC/SBV, & Payouts

Prop trading in Vietnam is quietly moving from niche to notable. Traders from Ho Chi Minh City, Hanoi, and Da Nang are turning to prop evaluations (thi quỹ ...

Prop Firm Rule Changes: 3 Major Shifts Every Trader Must Know

The proprietary trading firm industry is in a phase of rapid maturity, and the rules of the game are changing. Over the last months, major players like Lark ...

The Hidden Fine Print Behind Prop Firm Profit Targets

Series: AI, GEO & Prop Trading Reality Check – Part 2 This article grew directly out of trader comments on our AI search & GEO guide. If you want the ...

AI Search and Trading: How Traders Should Research Prop Firms

Series: AI, GEO & Prop Trading Reality Check – Part 1 This article kicks off an ongoing series built from real trader comments about AI search, GEO, and ...

Best Prop Trading Firms for German Traders (BaFin-aware, SEPA)

Prop trading in Germany appeals to traders who prize BaFin-aware conduct standards, Frankfurt’s market infrastructure, and efficient EUR payout rails. If ...

Top Prop Trading Firms for French Traders (AMF-aware, SEPA Payou

Prop trading in France is gaining traction among disciplined retail and semi-professional traders who want access to scalable capital, institutional-style risk ...

Prop Trading in Singapore: Rules, Costs, MAS, Payouts

For Singapore-based traders, the real edge isn’t location—it’s timing and cashflow. Sitting in GMT+8 lets you catch the last pulse of Asia and the full ...

Prop Trading in the Philippines: Rules, Costs & Payouts

Prop trading in the Philippines is maturing fast. Ambitious retail and semi-pro traders from Metro Manila to Cebu and Davao are turning to funded evaluations to ...

Prop Trading in Hong Kong: Best Prop Firms, SFC Rules & Tips

Prop trading in Hong Kong attracts serious retail and semi-professional traders thanks to its sophisticated financial ecosystem and strong rule of law. If you’re ...

Prop Trading in Indonesia: Best Prop Firms, Rules & Tips

Prop trading in Indonesia is gaining momentum as retail traders seek capital access, professional risk frameworks, and scalable profit splits—without committing ...

Prop Trading in Bangladesh: Best Prop Firms & Rules

Prop trading in Bangladesh is gaining real traction. Retail traders are looking beyond traditional brokerage accounts to access firm capital, modern platforms, and ...

Prop Trading Firm Affiliate Programs That Pay the Most

Affiliate marketing has evolved into one of the most profitable side-income models in modern finance. Within the proprietary trading world, Prop Trading Firm ...

How and Why Prop Affiliate Programs Work (2025 Guide)

Affiliate marketing has become one of the fastest-growing revenue channels in finance. Within prop trading, Prop Firm Trading Affiliate programs give marketers, ...

Prop Trading in Australia (2025): ASIC Rules & Best Prop Firms

TL;DR: Prop trading is legal in Australia. If a program distributes CFDs to Australian retail clients, ASIC rules (AFSL, DDO, leverage caps to 23 May 2027) apply. ...

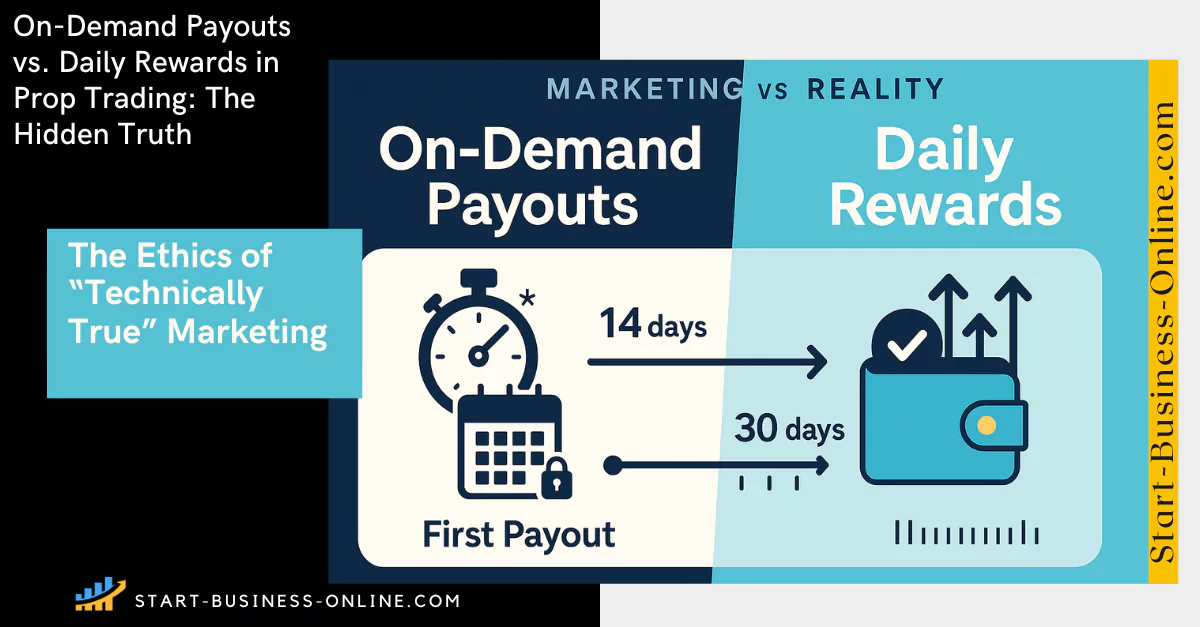

On-Demand Payouts vs. Daily Rewards in Prop Trading: The Hidden

The Hidden Realities of Payouts No One Talks About When evaluating prop trading firms, traders are often lured by flashy terms like “daily payouts” or ...

No Activation-Fee Prop Firms: Data, ROI Math & Best Options

What $0 Activation Actually Changes in Your P&L Activation fees sit quietly between you and your first payout. Some futures prop programs remove this cost ...

The Truth Behind “Daily Payouts” in Prop Trading: Busting the My

In the competitive world of prop trading, firms are racing to offer faster payouts to attract serious traders. “Daily payouts” has become the new marketing ...

Balance-Based Drawdown vs Equity-Based Drawdown in the Prop Firm

Drawdown rules are among the most critical elements of any proprietary trading challenge. Whether you're navigating a 2-step evaluation or instant funding model, ...